Which is the best crypto to buy now?

New York, 27 November 2025 – The cryptocurrency market is highly volatile, with prices fluctuating significantly. This information is for educational purposes only, and you should conduct your own research, seek expert advice, and consider your risk tolerance before investing. Cryptocurrency investment can be as risky as gambling, and you should only invest money that you are prepared to lose.

Which is the best cryptocurrency currently (27 November 2025)?

According to the latest market analysis and expert recommendations, Bitcoin (BTC) is currently considered the best and safest option for investment. It is the ‘king’ of the crypto market and ideal for long-term investment. It ranks first among various reliable sources such as Forbes and CoinDCX. Below, I provide detailed information about it, along with a list of other favorable options.

What is the best of Bitcoin (BTC)? Best crypto to buy right now?

Current price and market status: The latest price as of 27 November 2025 is approximately $91,160. The market capitalization exceeds $1.73 trillion, accounting for more than 58% of the total crypto market. The trading volume over the past week has exceeded $43.43 billion, indicating its high liquidity.

Reason for investment:

Digital Gold: Bitcoin is referred to as ‘digital gold’ because it serves as a store of value. It proves to be a safe option during inflation and economic uncertainty.

Institutional acceptance: Investment in Bitcoin has increased through large companies like MicroStrategy and Tesla and via ETFs (Exchange Traded Funds). In 2025, the approval of ETFs in the US has raised its price by 20%.

Historic return: Since 2010, Bitcoin has delivered over 10,000% returns. After the 2024-25 halving event (which reduces the creation of new coins), the supply decreases, potentially leading to a price increase.

Lower risk: Less volatile than other altcoins, but still start with a small investment.

Future prospects: According to experts, there is a possibility of exceeding $100,000 by 2026, especially if the Federal Reserve reduces interest rates. However, declines may occur due to geopolitical tensions or regulations.

Other top crypto options (for various risk levels) If you want diversity, invest a little in the cryptocurrencies below. These are based on Forbes’ top 10 list as of 26 November 2025:

Ethereum (ETH): Second best after Bitcoin. It is for smart contracts and due to the 2025 upgrades (such as Dencun), transaction costs have decreased. It is excellent for long-term investment.

Solana (SOL): High growth potential, but increased risk due to network outages. Popular for DeFi and gaming.

Cardano (ADA): Sustainable and research-based, suitable for applications in Africa.

Overall Market Trends (November 2025)

The cryptocurrency market has reached $2.98 trillion, with BTC and ETH accounting for 70% of it.

Positive trend in 2025 due to regulatory reforms (such as the EU’s MiCA) and the growth of ETFs.

However, there is uncertainty and geopolitical risks following the American elections. Altcoins are 2-3 times more volatile than BTC.

Final suggestion on Bitcoin

Currently, it is the best time to buy Bitcoin, as it forms the foundation of the market and offers long-term stability. Initially, invest a small amount of $100-500 and use the Dollar-Cost Averaging (DCA) method – that is, purchase a little each month. Start on platforms like Binance, Coinbase, or WazirX, but complete KYC and use a secure wallet.

Ethereum Upgrades: A Detailed Guide

Ethereum is a cryptocurrency and blockchain platform that is continuously evolving. Its upgrades improve the network’s scalability, security and sustainability. These upgrades are known as ‘hard forks’, where the rules of the network are changed. Here, I provide information about the history of Ethereum’s major upgrades, as well as recent and upcoming upgrades. This information is based on the latest sources (up to 27 November 2025). Please note, this is educational; seek expert advice for investments.

A brief history of Ethereum upgrades

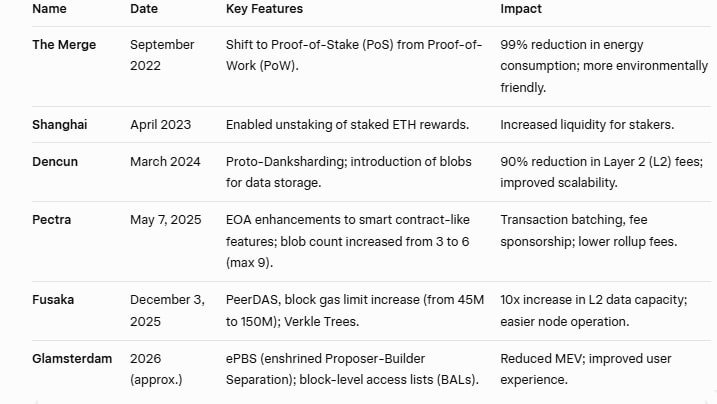

Ethereum was launched in 2015 and has since undergone several upgrades. Main objective: to make transactions faster, reduce fees, and lower energy consumption. The table below lists the main upgrades:

Pectra Upgrade (May 2025): Recent Success

Pectra was the first major upgrade of 2025. It has:

External ownership accounts (EOAs) were given features similar to smart contracts, such as batch processing of transactions and fee sponsorship.

Max has increased the effective balance for stakers.

The number of blobs was increased, which significantly reduced the fee on layer 2 (such as Arbitrum, Optimism).

Result: Ethereum’s daily transactions have increased by 100% and DeFi/NFT apps have become easier for developers.

Fusaka Upgrade (December 2025): The Upcoming Major Change

The Merge is a significant milestone in Ethereum’s roadmap, scheduled to go live on the mainnet on 3 December 2025. This upgrade focuses on scaling and value accrual. The main objective is to increase Ethereum’s transaction capacity while maintaining security and decentralization.

Key Technical Changes:

Peer Data Availability Sampling (PeerDAS): Validators will be able to verify small samples instead of downloading entire blobs. This will reduce bandwidth by 90% and make node operation easier.

Block gas limit increase: from 45 million to 150 million. Each block will include more transactions, smart contracts and L2 data.

Verkle Trees: Make blockchain state storage more compact; proofs are smaller and verification is faster.

Blob Fee Floor (EIP-7918): L2 usage will generate more revenue for ETH holders. For example, if this were active from 2024, an additional $78 million revenue would have been earned by October 2025.

Impact:

For users: Fees are 50-70% lower; faster and cheaper transactions on L2. However, during the upgrade (2-3 hours), ETH and ERC-20 deposits/withdrawals may be paused, but trading will continue.

For developers: A scalable platform for DeFi, NFT and gaming apps; the L2 ecosystem will expand.

For ETH holders: Value accumulation will increase as L1 scaling will boost ETH revenue (staking yields will improve). According to Fidelity Digital Assets, this will make Ethereum a ‘cash-flow generating’ asset.

Testnets: Successful on Holski (1 October 2025), Sepolia (14 October) and Hudi (28 October); $2 million bug bounty programme.

Fusaka is part of a rollup-centric roadmap, where data availability is monetised for L2. According to Vitalik Buterin, the gas limit will increase by 50% in 2025-26, but the increase will not be uniform – it will focus on computationally heavy operations.

Future Roadmap (2026 and beyond)

Glamsterdam (2026): ePBS to reduce MEV (Maximum Extractable Value); BALs to improve user experience.

Overall focus: L1 scaling, data availability, and UX. By increasing Ethereum’s gas limit, it will meet global demand.

Final suggestion

Ethereum upgrades increase the price and usage of ETH, but the market remains volatile. After Foolish, investment in L2 apps will rise. For more information, visit ethereum.org.