Cardano Price Prediction 2026 To 2030 : Here is the analyst’s opinion

New York, 27 November 2025 : Cardano (ADA) is a decentralized blockchain platform that emphasises research-driven development and sustainable growth. Founded by Charles Hoskinson in 2015, this network operates on an ‘open source’ principle and is known for smart contracts, DApps (decentralized applications), and DeFi (decentralised finance).

As of November 2025 (up to 27 November 2025), Cardano’s price is approximately between 0.43 and 0.44 US dollars (USD). Although this price has slightly declined compared to previous months, there remains potential for future growth due to the volatility of the crypto market.

When estimating the price of Cardano, experts consider various factors: such as network upgrades (e.g., Hydra and Mithril), regulatory changes, comparison with competitors like Ethereum or Solana, DApp adoption, and the global economic situation. Analysts in the American market (such as Benzinga and PrimeXBT) take a more cautious approach to these estimates, as American regulatory bodies (SEC) maintain strict oversight on crypto. This article presents detailed price forecasts for 2026 to 2030 and includes the predictions of American analysts. These estimates are based on various sources and are subject to change.

Key factors affecting Cardano’s price

The future price of Cardano depends on several factors:

Technology upgrades: Updates such as Hydra (enhancing scalability) and Voltaire (governance) will make transactions faster and cheaper, thereby increasing adoption.

Market volatility: The crypto market can be stimulated by events such as a global economic recession or Bitcoin halving.

Regulation: In the US, prices may remain limited due to SEC policies, but favorable regulation in Europe or Asia will be beneficial.

Adoption: If the use of Cardano for digital identity and payments increases in Africa and developing countries, the price will rise.

Competition: The rivalry with platforms such as Ethereum 2.0 or Solana will be intense.

These factors cause variations in the estimates – some sources are cautious (0.5-1 USD) while others are optimistic (5+ USD).

Cardano Price Forecast by Year (2026 to 2030)

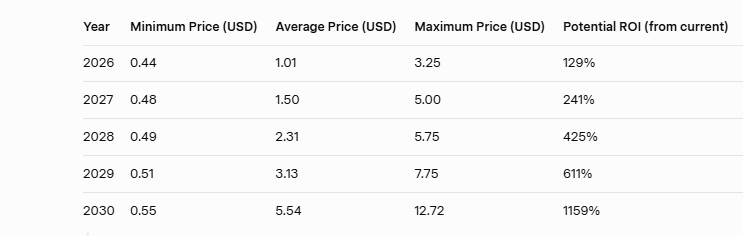

The following table presents averaged price predictions for Cardano (ADA) based on multiple analyst forecasts from sources like Benzinga, FastBull, Flitpay, ZebPay, Coinbase, and Binance. These are estimates as of November 27, 2025, with the current ADA price at approximately $0.44. Potential ROI is calculated as ((Average Price – Current Price) / Current Price) × 100%.

2026: The Beginning of Stabilization and Growth

In 2026, the price of Cardano is likely to range between $0.43 and $3.00, with an average of $1.20. According to PrimeXBT, this year will be for consolidation, with improved scalability due to the Hydra upgrade. CoinCodex predicts $0.43 – $0.62, while Investing Haven suggests $1.25-$3.03. In a bullish scenario, it could reach up to $3 due to DApp adoption, but macroeconomic headwinds may cause a decline.

2027: Network Maturity

In 2027, an average of $2.00, range $1.25 – $3.50. According to DigitalCoinPrice, this year will see a 40% increase, particularly due to the Basho phase. Investing Heaven suggests $3.3 – $3.4, where the role of institutional investment will be significant. Voltaire governance will increase holders’ confidence.

2028: Multi-dollar level

In 2028, $2.00 – $5.00, averaging $2.50. Changelly and PricePrediction.net suggest $2.4 – $2.9, while CoinStats is bullish up to $5.51. The Vasil upgrade will reduce fees, which will increase transactions.

2029: A Major Leap

In 2029, $2.50 – $6.00, average $4.00. DigitalCoinPrice predicts $2.68+, but Benzinga is cautious ($0.341 average for 2030). This year will be important for the long-term trends of the crypto market.

2030: Maturity and High Potential

In 2030, $3.00 – 7.00, with an average of $5.00. PricePrediction.net predicts $5.01 – $6.11, while TokenMetrics suggests $5-7. In a bullish scenario, 10+ USD is possible, but exercise caution due to regulatory risks.

Estimates of American market analysts (2026 to 2030)

American analysts are more reserved because of the uncertainty surrounding crypto due to institutions like the SEC. According to Benzinga (US-based):

2026: Average $0.866 (range$ 0.557 – $0.712). Hydra upgrade is beneficial, but there are limitations due to regulatory uncertainty.

2030: Average $5.23 (range $5.08 – $6.12), but alternative estimate $0.341 (range $0.130 – $0.801). Emphasis on stability and adoption in emerging markets.

In the analysis of PrimexBT (US-focused trading platform):

2026: Average $1.20 ($0.46 – $1.47), optimistic compared to Beijing’s $0.594.

2030: Average $5.50 ($4.84 – $6.11), bullish at $10.32. Industry adoption expected due to Hydra and Voltaire.

Coinbase (US-based exchange) models have cautious estimates of $0.44 for 2026 and $0.51 for 2029, prioritising market stability. Overall, American experts consider a rise up to $5 possible, but due to competition and regulations, they prefer $1-$2.

Conclusion

The price of Cardano could start from $0.43 and reach up to $7 between 2026-2030, with an average possibility of $5. While American analysts remain cautious, technological advancements and adoption suggest a bullish outlook. Investors should conduct their own research and manage risks, as the crypto market is volatile. In the future, Cardano will be recognized as a ‘green crypto’, which will increase its long-term value.

Notice: These estimates are for educational purposes and are not financial advice. Please consult a professional advisor.

Disclaimer: These estimates are for educational purposes and are not financial advice. The crypto market is risky.