SRFM Stock Forecast 2026 To 2030: Analysts’ Target Prediction

New York, 01 December 2025, SRFM Stock News │ Surf Air Mobility Inc. (NYSE: SRFM) is an American company working towards revolutionizing regional air transportation. The company focuses on hybrid-electric aircraft technology and software-based air traffic management. Listed on the NYSE, the company’s shares (SRFM) have been volatile, dropping after reaching $8.80 in July 2025. In this article, we will discuss SRFM’s stock forecasts (Penny Stocks) from 2026 to 2030, target predictions by American stock market analysts, the company’s strengths and weaknesses, future strategy, and current debts in detail. This information is based on various reliable sources and will serve as a guide for investors.

About the Surf Air Mobility Inc. company

Surf Air Mobility was established in 2013 and is recognized for revolutionizing regional air transport. The company’s core business focuses on developing hybrid-electric powertrain technology, leasing aircraft, and optimizing air transport through its software platform. In the third quarter of 2025 (Q3 2025), the company reported revenue of $29.2 million, exceeding guidance, but also incurred a net loss of $27.2 million. The company’s transformation plan is progressing towards achieving profitability in 2025.

Positive point

Many analysts are optimistic about the growth potential of surf air mobility. Here are the main positive points:

- Innovative Technology: The company focuses on hybrid-electric powertrains, which can electrify existing aircraft frames. This is environmentally friendly and cost-reducing, providing potential for long-term growth.

- Revenue Growth: Recorded revenue of $29.2 million in Q3 2025, which is an improvement over the previous quarter. The company is targeting revenue of more than $100 million for 2025-2026. This will be possible due to software and electrification sales.

- Strategic Partnership: Agreements with companies like Palantir and $100 million strategic deals (November 2025) provide a strong foundation for the company’s growth. These deals strengthen the balance sheet.

- Software Focus: The company is now concentrating on the sale of aviation software, which will simplify scaling and increase profit. In Q3, the adjusted EBITDA loss remained limited to $9.9 million.

- High Appreciation Opportunity: As the current share price is low (around $2-3), it is attractive for long-term investment. Analysts suggest the possibility of an increase up to $10-18.

Negative Point

On the other hand, the company faces several challenges, which have kept the shares volatile. The main negative points are as follows:

- Continuous Losses: In Q3 2025, there was a net loss of $27.2 million, which, although 3% lower than Q2, still leaves the expectation of profit distant. Negative equity and high debt ratios are causing concern among investors.

- High Cash Expenditure: Quarterly cash expenditure is high, and with low cash balance, there is a liquidity risk. This increases the likelihood of dilution (share increase).

- Debt and Liabilities: Total debt is $90.65 million (as of June 2025) and long-term debt is $83.52 million (as of September 2025). Total liabilities amount to $199.34 million, posing a threat to financial stability.

- Stock Volatility: Shares fell by 7.46% due to rising fuel costs and delayed electrification. Negative margins and volatile trading force investors to refrain.

- Competition and Regulation: Intense competition in the aviation sector and environmental regulations may slow growth. The company’s scaling pains are not structural failures but are risky.

The company’s future strategy :

Surf Air Mobility announced a four-phase transformation plan in November 2024, which is being implemented in 2025. The main strategy is as follows:

- Phase 2: Optimization (2025-2026): Optimizing airline services to return to profitability in 2025. Reducing cash expenses and lowering liabilities through a $50 million term loan.

- Software and Electrification Sales: The company now focuses on the sale of software platforms and electrification solutions instead of airline services. This is intended for regional air transport companies.

- Strategic Financing: Balance sheet strengthened through a $100 million transaction and $50 million financing in November 2025. This will provide support for growth and profitability.

- Long-Term Goal: To achieve over $100 million in revenue and profit by 2026. The company is prepared to meet the future needs of the aviation industry.

Current loans (Until December 2025)

According to the latest financial information up to December 2025, Surf Air Mobility’s total debt is $90.65 million (as of June 2025, long-term debt was $83.52 million in September). Total liabilities amount to $199.34 million, including leases and unearned revenue. The company has obtained a $50 million term loan from Comvest Partners, with the maturity of secured debt extended until December 2028. Liabilities were successfully reduced in Q3 2025, however, the high debt ratio risk remains.

SRFM Stock Forecast 2026 to 2030

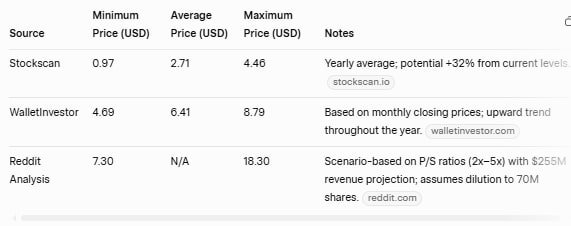

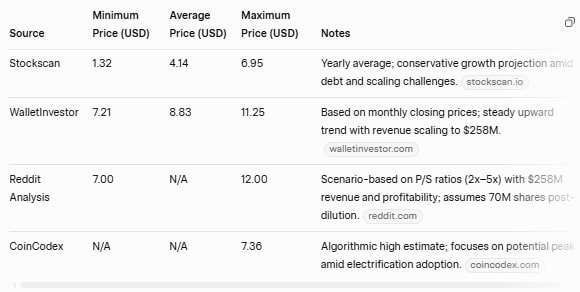

SRFM’s long-term forecasts are varied, as the company is risky but potentially rewarding. Main projection:

SRFM Stock Price Prediction 2026

Average $3.42 (low $3.39, high $4.00). Some sources report up to $7.90.

SRFM Stock Price Prediction 2027

SRFM Stock Price Prediction 2028

SRFM Stock Price Prediction 2029

SRFM Stock Price Prediction 2030

Average $5.90 (low $2.35, high $9.45). Wallet Investor predicts $14.97, while CoinCodex $1.43.

Target forecasts of American stock market analysts

It is $6.50-$7.75, indicating an increase of 183% – 260% from the current price. The high target is $12.00 (Canaccord Genuity) and the low is $3.50. The one-year target is $8.03 (November 2025). Seeking Alpha states $12.30. These forecasts are based on the conversion plan and partnerships, but depend on risk mitigation.

Conclusion

SRFM is a high-risk, high-return stock. While the positive side is based on innovation and growth, the negative side, due to economic instability, compels investors to be cautious. Although future strategy may lead to profit, there is a $90 million debt challenge. Growth of $5-15 is possible by 2026-2030, but analysts indicate a short-term target of $7-8. Seek professional advice before investing. As the market is changing, follow regular updates.

Disclaimer: This is not financial advice. Share prices are volatile and the market is subject to risks. Seek the assistance of a professional advisor before investing.