NVAX Stock Price Forecast 2026 To 2030: Analysts’ Target Prediction

New York, 01 December 2025, NVAX Stock News │ Novavax Inc. (NASDAQ: NVAX) is an American biotechnology company primarily focused on developing vaccines. The company is mainly recognised for its COVID-19 vaccine ‘Nuvaxovid’, which is based on protein-based technology and differs from mRNA vaccines. By December 2025, the company has obtained approval from the U.S. Food and Drug Administration (FDA) for an updated formulation of the COVID-19 vaccine, which is likely to strengthen its market position for the 2025-2026 season.

However, the company faces challenges such as declining revenue, high debt, and market competition. In this article, we provide a detailed review of Novavax Stock Price projections from 2026 to 2030, analysts’ target forecasts, the company’s strengths and weaknesses, future strategy, and current debt situation. This analysis is based on financial results from the third quarter of 2025.

Positive and Negative Aspects: SWOT Analysis of the Company

It is necessary to study the strengths, weaknesses, opportunities, and threats of Novavax, which provides investors with a clear picture.

Positive aspects (strengths and opportunities)

- Unique technology of protein-based vaccines: Nuvaxovid is the only non-mRNA COVID-19 vaccine available in the United States, approved by the FDA for individuals over 65 years old and high-risk groups over 12 years old. These features are appealing to vaccine-hesitant consumers and can provide a competitive advantage in the market.

- Collaboration and milestone payments: Partnership with large companies like Sanofi is expected to result in milestone payments of 75 million dollars by 2026. Additionally, a reimbursement of 30-40 million dollars for R&D is anticipated, which will boost research.

- Financial Performance: Revenue for the third quarter of 2025 reached 70.45 million dollars, which was 26.57% higher than estimated. The company has reduced costs through site consolidation, with expected savings of 60 million dollars.

- New Opportunity: Research on influenza-COVID combination vaccines and other viral diseases, potentially leading to long-term growth.

Negative aspects (weaknesses and threats)

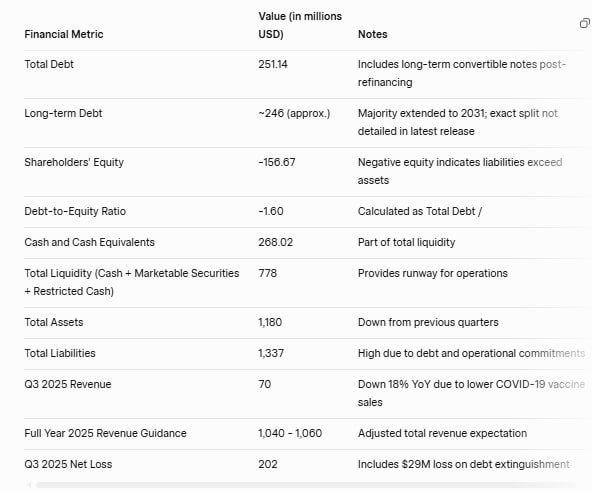

- Revenue decline: Due to the sale of the COVID-19 vaccine, revenue decreased by 18% in 2025. Although total revenue for 2025 is expected to be 1,040-1,060 million dollars, for 2026 it is projected to be only 185-205 million dollars (excluding royalties), which will result in a delay in profit.

- High debt and Negative Equity: The company’s total equity is -156.7 million dollars, resulting in a debt-to-equity ratio of -155.6%. This indicates financial instability.

- Regulatory and market risks: Costs increase due to the FDA approval process and government regulations. Vaccine skepticism and competition (such as mRNA vaccines) affect sales.

- Challenges in staff reduction and operations: In 2025, operations were affected due to a 12% staff reduction and site closures. Property damage and revenue instability are the major issues.

Current debt and financial situation

By the end of September 2025, Novavax’s total debt stands at 250 million dollars, including 246 million dollars in long-term debt. In August 2025, the company converted the majority of its 2027 notes into debt, thereby extending the maturity. However, negative shareholder equity (-156.7 million dollars) and a high debt-to-revenue ratio (246 million debt to 5 million revenue in 2025) pose risks to the company. The imbalance between total assets and liabilities requires the company to continually undertake efforts to reduce debt, such as site consolidation and partnership agreements.

The company’s future strategy

Novavax has outlined a clear growth strategy for 2025-2026. Key points:

- Focused on the COVID-19 vaccine: With the 2025-2026 formula approved by the FDA, increase distribution for high-risk groups. This will be the company’s immediate source of revenue.

- Cost reduction and operational improvement: Reducing corporate expenses through site consolidation, resulting in a saving of 60 million dollars. Developing new vaccines by focusing on R&D.

- Partnerships and Milestones: Achieving 75 million in milestones and R&D returns by 2026 through Sanofi-led launches and licensing agreements. Although profitability is delayed, stability is expected after 2026.

- Long-term research: Developing combined vaccines for influenza and other diseases, which will lead to diversification.

This policy will keep the company afloat in the anti-COVID market, but success is uncertain due to competition and regulations.

Target forecast of American stock market analysts

American analysts (such as Yahoo Finance, TradingView) give Envax a ‘hold’ rating. The average target price for 2025 is between $10.78 and $14.50, with a maximum of $18.00 and a minimum of $11.00. The majority of 9 analysts suggest ‘hold’, indicating an expected increase of 52.91%. Some analysts (such as Intellectia) forecast $17.70 for February 2026. However, due to declining revenue, the target price has been lowered from $13.21 to $13.11.

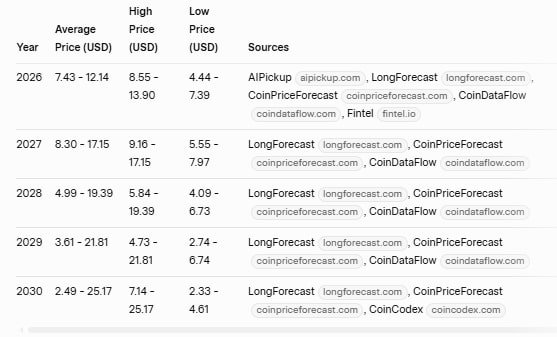

NVAX Stock Price Forecast 2026 To 2030 : Novavax Stock Price Prediction

Novavax Stock Price estimates vary across different sources, reflecting the company’s volatility. The table below shows the main estimates:

Some sources (such as Coinpriceforecast) are optimistic and expect it to reach $20 by 2030, while others (such as Walletinvestor) suggest it may be limited to $6-7. The average forecast for 2030 indicates $6-8, depending on the company’s growth. There are doubts about whether the company will survive the next 10 years due to ongoing losses.

Conclusion

The period 2026-2030 will be challenging yet opportunistic for EnVax. Positive aspects such as the non-mRNA vaccine and partnerships will drive growth, but debt, revenue decline, and regulatory risks will impose constraints. Analysts recommend ‘hold’ with forecasts ranging from 5 to 20 dollars. Investors should monitor the company’s Q4 2025 results and 2026 milestones. This is not investment advice but research-based.

Disclaimer: This is not financial advice. Share prices are volatile and the market is subject to risks. Seek the assistance of a professional advisor before investing.