RKLB Stock Forecast 2026 To 2030: NASDAQ: RKLB Target Prediction

New York, 01 December 2025, RKLB Stock News | Rocket Lab Corporation (NASDAQ: RKLB) is a leading American space technology company specializing in small satellite launches and space systems. With the rapid growth of the space industry, it has captured the attention of investors. In this article, we will discuss in detail RKLB’s projected share prices from 2026 to 2030, American stock market analysts’ target predictions, the company’s strengths and weaknesses, future strategies, and current debt. This information is sourced from various reliable sources and highlights the future opportunities and challenges in the space sector.

Current situation and market position

As of December 2025, RKLB shares are trading around $42-45, giving the company a market capitalization of approximately $25 billion. In the third quarter (Q3 2025), the company recorded a record revenue of $155 million, representing a 48% increase compared to the previous year. The company’s backlog stands at $1 billion, providing assurance of future revenue. Nevertheless, competition in the space industry (such as SpaceX) and technical challenges remain significant for the company.

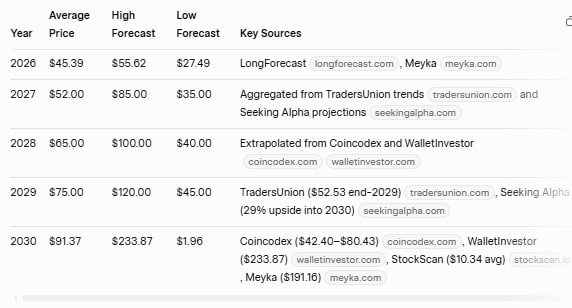

RKLB Stock Forecast 2026 To 2030

The long-term forecasts of RKLB’s share price vary among different analyst firms, depending on the success of the company’s Neutron rocket and the growth of the space market. Here is a summary of the main forecasts:

RKLB Stock Forecast 2026

According to most estimates, the share could reach $60. According to CoinPriceForecast, it could be $60 by the end of the year, while LongForecast estimates it may rise from an average of $35.15 in January to $62.98 by December.

RKLB Stock Forecast 2027

An increase up to $85 is expected. According to the Traders’ Union, by 2029 it will be $52.53, but other sources are more optimistic.

RKLB Stock Forecast 2028-2029

Possibility of reaching up to $100. According to StockScan, the average by 2030 is $10.34, but optimistic sources like WalletInvestor predict up to $233 (which seems to be an outlier).

RKLB Stock Forecast 2030

Range $10 to $234, average $42.40 to $80.43. According to CoinCodex, $42.40-$80.43, whereas Reddit discussions expect a $100 billion market cap. According to Motley Fool, by 2030, the share could rise up to 29% with earnings of $673 million.

These estimates depend on the $1 trillion size of the space market (by 2030), in which RKLB’s share will increase. However, they are uncertain and depend on market fluctuations.

RKLB Stock Target forecasts of American stock market analysts

By the end of 2025, 13-14 analysts have given RKLB a ‘Buy’ rating. The average target price ranges from $50.38 to $65.67, indicating an increase of 19%-53% from the current price.

- High Target: $83 (from some institutions).

- Target Range: $47-$51.

- Key Updates: Needham ($63, November 2025), B of A Securities ($60), Morgan Stanley ($67). According to TipRank, the average is $65.17.

These targets are based on Neutron launch and revenue growth, with revenue of $892 million expected for 2026.

Positive aspects of Rocket Lab Corporation

Rocket Lab is a strong player in the space industry. Here are the main positive points:

- Innovative Technology: Electron Rocket has successfully conducted over 50 launches, making it ideal for small satellites. Neutron (a medium-to-high capacity reusable rocket) will be available in 2026, providing a competitive advantage.

- Revenue growth: 48% YoY increase in Q3 2025 ($155M), with $596M expected for 2025. Diversification in space systems and launch services.

- Backlog and Operational Agility: $1B backlog, with a goal of 20+ electronic launches in 2025. Fast launch turnaround in Q1 2025.

- Long-term opportunity: Due to the growth of the space market (up to $1T by 2030), a 5x increase in RKLB is possible (according to Wall Street 247).

These aspects enable the company to compete with giants like SpaceX.

The negative aspects of Rocket Lab Corporation

Nevertheless, the challenges are significant:

- Financial loss: Continuous operating losses and negative cash flow (until 2026). Turnaround expected by 2027, but risks remain.

- High valuation: PS ratio 49.36x (above the industry average of 2.99x), resulting in a 20% drop.

- Technical delay: Neutron launch postponed from 2025 to 2026, resulting in reduced confidence.

- Competition and market risk: Market share has decreased due to companies like SpaceX. Backlog fell from $1B to $1.067B.

These aspects make the investment risky.

The company’s future strategy

Rocket Lab’s strategy is focused on becoming a full-stack company in the space industry:

- Launch expansion: 20+ electron launches in 2025, and the first Neutron launch in 2026 (with ocean landing reusability).

- Revenue growth: 40% YoY increase, $892M for 2026. Expanding space systems (satellites).

- Strategic partnership: Agreement with NASA and DoD. $575M contract for Neutrons.

- Long-term vision: Real value growth post-2030, encompassing reusable technology and market expansion (according to MLQ.ai).

It is believed that this policy will lead the company to a $100B market capitalization.

Current debt and financial situation

By December 2025, RKLB’s total debt is $440-$468 million. Net debt is $197M, and total liabilities are $801-$940M. Debt to equity appears to be 0.00, but financial leverage is -0.49, indicating negative cash flow. For Q4 2025, revenue of $170-$180M is expected, with a gross margin of 37%-39%. The company relies on revenue growth for debt management.

Conclusion

RKLB is a high-growth company in the space sector, with a projected share price of $60-$100+ by 2026-2030. Analysts give a ‘buy’ signal with an average target of $65. Positive aspects (innovation, growth) indicate a bright future, but negatives (losses, delays) increase risks. Neutron success and debt management are important. Investors should have a long-term perspective but consider market risks. This information is general; seek professional advice.

Disclaimer: This is not financial advice. Share prices are volatile and the market is subject to risks. Seek the assistance of a professional advisor before investing.