TLRY Stock Price Forecast 2026 To 2030: Penny Stocks Under $1

New York, 02 December 2025 │ Tilray Brands Inc. (NASDAQ: TLRY) is a key player in the cannabis industry, focusing on medical research, cultivation, processing, and consumer products. The company operates in the United States, Canada, and Europe, and its share price is always dependent on regulatory changes. In December 2025, TLRY’s stock price is approximately between $0.78 and $0.80. This article will discuss the TLRY Stock Price Prediction from 2026 to 2030, analysts’ target prices in the US stock market, the company’s positive and negative aspects, its debt status and plans, as well as the US government’s cannabis policy. This analysis is based on various financial sources and will serve as a guide for investors.

Target price estimate of analysts in the US stock market

Top US stock market analysts have a neutral to cautious view on TLRY stocks. As of the end of 2025, the average 12-month target price from seven analysts is $2.00, with a high of $3.00 and a low range of $0.85 to $1.00. Jefferies set a $2.00 target in August 2025, while other analysts estimated a range between $0.86 and $2.62. Overall, from the opinions of 10 analysts, the average target price is $1.83 with a ‘Hold’ recommendation. According to Fintel, the share price could reach $1.89 by November 2026. These projections depend on the company’s revenue growth and regulatory changes, but most analysts remain cautious as the company is still not profitable.

The positives and negatives of Tilray Brands Inc.

Tilray Brands is a strong player in the cannabis sector, but investing in its shares is high-risk and high-reward.

Positive things:

- Industry leadership and expansion: The company is expanding in North America and Europe and is leading in medical cannabis research. Its products include beverages, vitamins, and other consumer goods, adding to its diversification.

- Opportunities from regulatory changes: U.S. cannabis rescheduling (to Schedule III) could lead to banking access, institutional investment, and tax benefits, potentially boosting share prices. Shares have jumped 94.5% due to the Trump administration’s policies.

- Recent profit surprise: In October 2025, the company reported better-than-expected profits, leading to an immediate rise in its shares. Also, there has been a 94.5% increase over three months, which some analysts say makes this a buying opportunity.

- Strong fundamentals: The company’s market capitalization and product diversity are good for long-term growth, especially since the cannabis market is expected to boom by 2030.

Negative Aspects:

- Lack of profit and weak revenue growth: Over the past five years, the share price has dropped by more than 90% and the company is still making losses. Sales growth is only about 2.5%, while returns are negative.

- Risk and instability: Regulatory uncertainty and competition in the cannabis industry make the shares volatile. According to sources like Stock Invest.As, there are selling signals from short and long term moving averages.

- Value destruction: The company has given a negative return on capital, which is eroding value. Also, the sales forecast for 2025 has been lowered.

- High risk: If there are no regulatory changes, the shares could fall further, and the company’s growth is still lacking.

Overall, TLRY is a high-risk investment that depends on positive regulatory changes.

The company’s debt situation and plan

Tilray Brands focused on reducing debt in 2025, which has improved its financial position. As of February 2025, total debt is 138.5 million dollars, down 62.89% from 373.2 million dollars in 2024. Total shareholder equity is 1.5 billion dollars, with a debt-to-equity ratio of 16.6%. The company has 248 to 256 million dollars in cash and marketable shares.

In plans to reduce debt:

Debt has been reduced by 71 to 100 million dollars in the financial year.

- 10:1 reverse stock split (effective from December 2025), which will stabilize the share price and avoid the risk of Nasdaq delisting.

- Sales forecast for 2025 has been cut due to strategic adjustments, but priority is on reducing debt.

- These efforts will lead the company towards financial stability, but still, debt management will remain important.

Impact of US government cannabis policy on Tilray brands

The US government’s cannabis policy in 2025 is mixed, giving companies like Tilray both opportunities and risks.

- Positive change: In August 2025, it was recommended to reclassify marijuana as less dangerous (Schedule III), which could allow access to banking, institutional investment, and 280E tax benefits. Cannabis shares have doubled due to the ‘Trump effect’ of the Trump administration, and the company will benefit from this.

- Negative points: The government funding bill in November 2025 includes a provision to ban hemp-based THC products, which could harm the hemp market. Tilray has condemned this as a ‘false prohibitionist measure’, and this bill will impact consumer interests. Companies like Tilray could suffer, just like Curaleaf.

Overall, even though reclassification is positive, the hemp ban adds uncertainty. Tilray will still depend on its expansion in Europe.

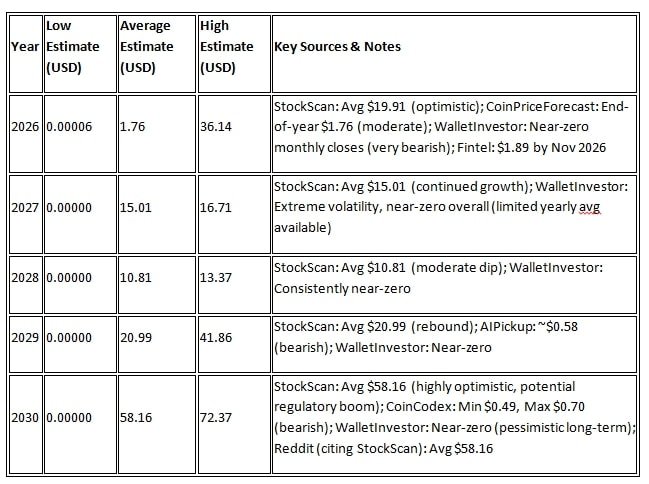

TLRY Stock Price Forecast 2026 To 2030

Estimates for 2026 to 2030 vary as they depend on regulatory changes, revenue growth and market conditions. Most estimates are of a slowdown or low growth

TLRY Stock Price Forecast 2026

Average price $0.55 to $1.76. According to CoinPriceForecast, $1.76 by the end of the year; according to AI Pickup, $0.57 by November 2026. Fintel: $1.89.

TLRY Stock Price Forecast 2027 2029

Stable or low, around 0.58 to 0.70 dollars. Intellectia AI: 0.55 dollars by May 2026.

TLRY Stock Price Forecast 2030

CoinCodex: $0.49 to $0.70; Reddit: $58.16 (exceptionally positive); Wallet Investor: almost zero ($0.0000583). Stockscan: average $58.16 by 2030 (high $72.37).

Overall estimates are mixed, but if regulators make positive changes, it could go above $2.00. In a recession scenario, it might stay below $0.50.

TLRY Stock Price Prediction 2026 to 2030

Conclusion

Tilray Brands Inc. is an opportunity in the cannabis revolution, but you should be cautious when investing in its shares. Analysts have an average target of $2.00, though forecasts for 2026-2030 are lower. On the positive side, there is potential for growth and regulatory opportunities, while on the negative side, there are losses and risks. Plans to reduce debt will bring stability, but uncertainty in US policies (reclassification versus hemp ban) is important. Investors should do their own research and take a long-term view. This analysis is based on information up to December 2025, and the market may change.

Disclaimer | This is not financial advice. Share prices are volatile and the market is subject to risks. Seek the assistance of a professional advisor before investing.