ASRT Stock Price Forecast 2026 To 2030: Penny Stocks Under $1

New York, 02 December 2025 │ Assertio Holdings Inc. (NASDAQ: ASRT) is a leading American pharmaceutical company that develops and sells specialized products in areas such as neurology, inflammatory diseases, pain management, and oncology. The company was founded in 2007 and currently holds a portfolio of eight FDA-approved products. This includes products such as INDOCIN (for rheumatoid arthritis), Indaflex (NSAID for pain), and Rolvedon (for cancer patients). The company’s focus is on a patient-centred approach, which has helped it secure a strong market share in the pain management and oncology sectors. In the third quarter of 2025, the company reported better than expected revenue ($49.459 million) and profit, boosting confidence in its growth potential. However, stock market volatility and regulatory challenges mean that the ASRT stock price is currently trading around $0.80 to $1.00. In this article, we will conduct a detailed study of the ASRT Stock Price Forecast from 2026 to 2030, the target prices of American analysts, the company’s positive and negative aspects, its debt situation and plans, as well as the policies of the American government regarding the company’s products.

The positive and negative aspects of Assertio Holdings Inc.

Positive aspect

Assertio’s strength lies in its specialized product portfolio, which establishes a strong position in the fields of neurology, inflammatory diseases, and pain management. The company delivered revenue and profit surprises of 83.86% and 237.50% respectively in the third quarter of 2025, maintaining its market share leadership. The consistent sales of products like Rolvedon have ensured an uninterrupted patient supply, and the company’s business development strategies have enhanced growth potential. Additionally, the relative stability of the share price (reduced volatility over the past three months) is attractive to investors. The company’s patient-centric approach and expansion in the oncology sector are indicators of long-term success.

Negative aspect

On the other hand, the company’s revenue growth forecast is weak, indicating sluggish income growth. Although the share price has increased by 11% over the past three months, it has declined by -7.45% on an annual basis. A momentum score of 27 (weak) and a high debt-to-equity ratio (37%) increase the financial risk. Additionally, regulatory complaints (such as those regarding the marketing of fentanyl products) reduce confidence.

The company’s debt situation and strategy

Assertio’s debt position is under control, but improvement is needed. As of the third quarter of 2025, total debt stands at 39.767 million dollars, including long-term debt of 38.929 million dollars. The debt-equity ratio is 38.14%, which is moderate compared to total equity (105.8 million dollars). Net debt has decreased to 1.932 million dollars, enhancing the company’s liquidity.

The company’s plans emphasize reducing debt. The guidance for 2025 is based on revenue of 110-112 million dollars, and cash flow is expected to improve due to Rolvedon sales. Long-term debt has remained stable since 2011, and the company will manage debt through business development (such as acquisition of new products). Although the total liabilities are 213.972 million dollars, the leveraged free cash flow is 20.82 million dollars, indicating the capacity to meet future obligations.

The policy of the American government on the products of Assertio Holdings Inc.

Since Assertio’s products are primarily related to pain management and opioids, the US government’s policy is focused on the opioid crisis. According to the CDC’s 2022 guidelines, there is strict regulation on opioid prescriptions for pain management, including dosage limits for patients over 18 and prioritisation of non-opioid alternatives. In 2025, the FDA issued new guidance to expand non-opioid options, including safety changes in the labelling of opioid products (e.g., OxyContin).

The direct consequence for Assertio was having to pay a $3.6 million fine in May 2025 for violating the False Claims Act, due to misleading information provided in the marketing of its fentanyl products. According to the HHS Pain Management Task Force report (2019), there is a policy of caution regarding opioid prescriptions, which creates challenges for companies like Assertio in selling their products. However, the company’s NSAID-based products (such as Indaflex) are relatively safe in this regard. Overall, the government’s policy focuses on preventing opioid abuse, necessitating that Assertio concentrate on non-opioid products.

ASRT Stock Price Forecast by American stock market analysts

American stock market analysts maintain a positive to mixed outlook on ASRT shares. The average target price among four leading analysts for 2025 is $2.66, with a maximum of $3.00 and a minimum of $1.65. This indicates a potential increase of 225% to 316% from the current price (around $0.80). For instance, a firm like HC Wainwright has set a target of $3.00 for August 2025, based on the company’s turnaround efforts.

On the other hand, analysts on platforms like Wall Street Zen have projected an EPS (earnings per share) of -0.47 dollars for 2025, indicating short-term volatility. According to a report by Seeking Alpha, the company’s shares are considered overvalued by 300% on the upside, due to the potential revenue growth from successful product launches. Overall, while analysts recommend a ‘Buy’, they advise caution given the market uncertainty.

ASRT Stock Price Forecast 2026 To 2030

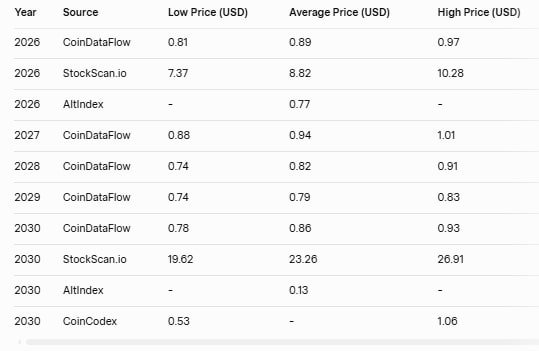

Long-term forecasts from 2026 to 2030 show a range of perspectives, including both positive and negative views. According to StockScan.io, although the average price in 2025 is likely to be $10.23, it is projected to remain between $9.18 and $11.28 for 2026. However, sources such as CoinDataFlow suggest that the price from 2026 to 2031 will remain between $0.75 and $0.90, resulting in an annual growth of only 5-10%.

According to AltIndex’s AI-based forecast, the price is expected to reach $0.75 in 2026 and $0.89 by 2030. Platforms like WalletInvestor are more pessimistic, citing a price range of $0.40 to $0.728 for 2026, indicating a long-term downtrend. According to Intellectia AI, the forecast is $0.54 for 2026 and $0.40 for 2030.

Overall, in a positive scenario (revenue growth and product success), the price could reach $2.74 (by 2026), whereas in a negative scenario (regulatory challenges) it could fall below $0.40. These estimates depend on the company’s revenue growth (for 2025, $110-112 million) and the sales of products like Rolvedon.

Conclusion

Assertio Holdings Inc. is a growth-oriented company with a strong presence in the pharmaceutical sector due to its product portfolio. With an average analyst target price of $2.66, positive growth is expected by 2026, although the estimated range of $0.75 to $2.74 by 2030 depends on risks. Positive factors include revenue success and market share benefits, while negative factors involve debt and regulatory challenges. Effective debt management and alignment with the government’s opioid policies will be important for the company. Investors should review current market trends and the company’s quarterly reports. These estimates may change according to market fluctuations.

Disclaimer | This is not financial advice. Share prices are volatile and the market is subject to risks. Seek the assistance of a professional advisor before investing.