PSTV Stock Price Forecast 2026 To 2030: Penny Stocks Under $1

New York, 02 December 2025 │ Plus Therapeutics Inc. (NASDAQ: PSTV) is a clinical-stage pharmaceutical company developing targeted radiation therapy for central nervous system (CNS) cancers. The company’s lead product, Rhenium Re 186 Obisbema (ReYobimic™), is designed for rare diseases such as brain cancers. By the end of 2025, the PSTV stock price is expected to be around $0.41 to $0.58, creating both excitement and uncertainty among investors. In this article, we discuss PSTV Stock Price Forecast from 2026 to 2030, target prices set by US stock market analysts, the Plus Therapeutics Inc. company’s positive and negative aspects, debt status and plans, as well as US government (FDA) policies on products. This information is based on various reliable sources and should not be taken as investment advice.

Positive and negative points of Plus Therapeutics Inc.

Positive points:

- Innovative technology: The company’s REYviobics is a targeted radiation therapy for CNS cancers, reducing off-target risks and improving patient outcomes. It is a revolutionary treatment for brain cancers.

- Clinical progress: FDA approval and orphan drug designation have been obtained for the Re-SPECT-LM trial, showing a 76% clinical benefit rate.

- Financial stability: Raised 15 million dollars by March 2025 and strong position through grants. This enables the company for growth.

- Growth potential: Competitive advantage in CNS oncology and integrated diagnostics make rapid growth possible.

Negative points:

- High risk: The company is at the pre-revenue stage and dependent on a single drug, which means a single failed trial could cause significant damage to the company.

- Financial Weakness: Negative EBIT margin (-103.9%) and ROA (-79.49%), as well as revenue in Q3 2025 being 36.79% below expectations.

- Analysts’ research: The average target price has been lowered over the past four months.

- Market volatility: High-risk investment with no dividends, reliant on growth.

The Plus Therapeutics Inc. company’s debt situation and plan

Plus Therapeutics’ debt situation is relatively stable, as long-term debt is limited. According to Alphaquirin, long-term debt data is not available until September 2025, indicating that the company does not seem reliant on debt. According to TradingView, the long-term debt to equity ratio is low.

In Q1 2025 (March 31, 2025), the cash balance was $9.9 million, strengthening the working capital. In Q2 2025, total assets increased, while in Q3, cash was $6.9 million.

Plus Therapeutics Inc. Company Plan:

The company is focusing on equity financing, having raised 15 million dollars in March 2025. Funding for clinical trials is underway through grants, stock purchase agreements, and non-dilutive funding. This is expected to complete the trials by 2026, improving cash flow.

US government (FDA) policy on company products

The US Food and Drug Administration (FDA) is responding positively to the products of Plus Therapeutics, particularly for rare diseases. In November 2025, the FDA held a meeting on Revaiobic’s future clinical development plans for leptomeningeal metastasis, which is likely to accelerate the trials.

In June 2025, the FDA granted clearance to RevyAerobic’s IND (No. 168178) application for pediatric brain cancer. In March 2025, it received orphan drug designation for leptomeningeal metastasis, providing tax benefits and market exclusivity. In June 2025, the FDA approved the Re-SpecT-LM dose optimization trial, reducing off-target risks.

In March 2025, RAYBIOC received an FDA-approved name, which helps in destroying cancer tissues due to the short half-life of Rhenium-186. Overall, the FDA’s policy encourages the company for rapid development, especially for orphan drugs.

PSTV Stock Price Forecast by American stock market analysts

Leading US stock market analysts have shown a positive outlook for Plus Therapeutics. According to MarketBeat, seven analysts have set an average 12-month target price of $7.25, with a high of $19.00 and a low of $2.00. According to Fintel, the average target price is $7.90, indicating a potential increase of 1,195% from the current price. On StockAnalysis.com, four analysts have given a ‘Strong Buy’ rating, with an average target of $7.25, suggesting a potential rise of 1,143%.

HC Wainwright & Company maintained a ‘buy’ rating in November 2025 with a target price of $2.00, while D. Borrell Capital also gave a ‘buy’ rating. Ascendant Capital raised the target price from $20.00 to $20.50 in June 2025, reflecting confidence in the company’s clinical progress. According to TipRanks, the average target is $7.75, with a high of $21.00, implying a 1,236% potential increase. Overall, analysts recommend a ‘strong buy’, emphasising the company’s clinical success with Reyovibic.

PSTV Stock Price Forecast 2026 To 2030 – Penny Stocks Under $1

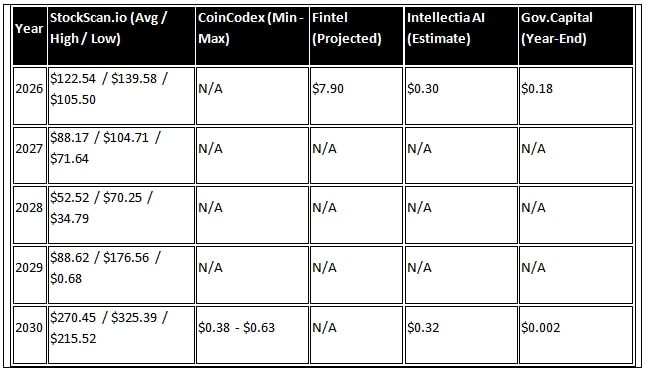

Long-term forecasts are mixed, as the company is in the clinical stage and market volatility is high. According to Stockscan.io, the average price by 2030 will be $270.45, with a high of $325.39 and a low of $215.52. However, CoinCodex’s estimate is more conservative: between $0.3770 and $0.6259 in 2030. According to Fintel, a price of $7.90 is expected by November 2026.

ValueInvesting.io’s 12-month forecast is $7.91, indicating potential for long-term growth. Intellectia AI has a negative forecast of $0.30 for 2026 and $0.32 for 2030, based on the company’s risks. WalletInvestor has provided data for 2030, which is skewed positively. Overall, forecasts range widely from $2 to $8 in 2026 and $0.30 to $270 in 2030, depending on clinical success and market adoption.

Conclusion

Plus Therapeutics Inc. is a high-risk, high-reward investment, with its share price potentially reaching $0.30 to $270 by 2026-2030 depending on the success of REVOYOBIC. Analysts’ targets of $7.25-$7.90 indicate positivity, while the company’s innovations and FDA support provide a strong foundation. However, attention must be paid to financial weakness and debt management. Seek professional advice before investing, as market changes can occur rapidly.

Disclaimer | This is not financial advice. Share prices are volatile and the market is subject to risks. Seek the assistance of a professional advisor before investing.