CODX Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 03 December 2025, CODX Stock Price Forecast │ Co-Diagnostics Inc. (NASDAQ: CODX) is a biotechnology company that develops molecular diagnostics, particularly tests based on real-time PCR (polymerase chain reaction) technology. The Co-Diagnostics Inc. company’s Co-DX PCR platform is new for point-of-care diagnostics, providing rapid and accurate tests for infectious diseases. The CODX stock, traded on Nasdaq (Best Penny Stocks to Buy), is currently priced at approximately $0.37, having declined due to the post-pandemic downturn in 2025. By December 2025, the company had faced financial challenges, but joint ventures and AI integration offer potential for future growth.

In this article, we will discuss the CODX Stock Price Forecast for 2026 to 2030, target prices from US market analysts, the company’s total debt, future plans, relevant US government policies, and the company’s strengths and weaknesses. This information has been compiled from various financial and regulatory sources and will serve as a guide for investors.

Total debt of the Co-Diagnostics Inc. company

Co-Diagnostics Inc.’s financial position is relatively stable, particularly in terms of debt. According to Yahoo Finance, the monthly resolution (MRQ) as of September 2025 indicates total debt of $1.47 million. Based on Companies Market Cap, total debt was $1.7 million as of June 2025, which includes long-term debt. The debt-to-equity ratio is 3.70%, and the company has $11.44 million in cash, giving a net cash position of $9.97 million ($0.16 per share). According to CSI Market, total debt was zero in the third quarter, but updated data shows $1.47 million. According to Finbox, total debt/total assets is 3.7%, which is the five-year high. Overall, low debt is a positive aspect, but cash management is important due to revenue decline (a loss of $5.9 million in Q3 2025).

Company Future plans

Codex’s future plan focuses on the expansion of the PCR platform. In October 2025, the company signed a joint venture (JV) with Arabian Eagles in Saudi Arabia, enabling the localization of PCR technology in 19 MENA countries. This includes tuberculosis (TB), 8-type HPV multiplex, and respiratory panel tests, with clinical evaluations set to begin by the end of 2025. In November 2025, the company announced the integration of proprietary AI models for AI-enhanced diagnostics, bringing real-time PCR to the point of care.

In the Q3 2025 evening call, the company outlined plans for custom assembly development and AI-backed diagnostics expansion, aligning with Saudi Vision 2030. In August 2025, the clinical trial timeline was announced, targeting major trials in 2025 and a commercial launch by mid-2026, particularly for the U.S. and international markets. In November 2025, clinical evaluations were initiated for U.S. FDA submission for the upper respiratory multiplex POC tests. The company is seeking strategic alternatives (such as mergers) in a timely manner, which will enhance the public health sector.

US government policies regarding the Co-Diagnostics Inc company’s production

The United States government, particularly the Food and Drug Administration (FDA), is implementing new policies for molecular diagnostics and PCR tests, which are beneficial for Codex’s Co-DX platform. In November 2025, the FDA proposed the reclassification of nucleic acid-based test systems, which would change Class I/FD devices to Class II, simplifying the approval process for new PCR tests. In September 2025, the FDA repealed the 2024 rules on lab-developed tests (LDTs), enhancing innovation and patient access, particularly for POC diagnostics.

By December 2025, the FDA had granted clearance to the first molecular POC test for Bordetella infections with CLIA waiver, paving the way for Codex respiratory tests. The March 2025 court ruling overturned LDT regulations, preserving innovation for critical diagnostics. The FDA’s Emergency Use Authorization (EUA) policy remains strong for PCR tests, such as real-time RT-PCR for SARS-CoV-2. In 2025, approvals for biological device applications increased, including automated blood grouping and antibody testing. This policy is positive for Codex TB and HPV tests, as the FDA prioritises POC and multiplex tests.

Positive and negative aspects

Positive aspects:

- New technology: Co-DX PCR platform and AI integration, providing rapid POC diagnostics and MENA market expansion due to JV.

- Low debt: $1.47 million in debt and $11.44 million in cash, sufficient for trials and expansion.

- Analyst support: ‘Strong Buy’ rating and over 400% growth forecast, based on clinical success.

- Government support: FDA’s LDT cancellation and POC clearance, which will boost innovation.

Negative aspects:

- Revenue decline: Loss of 5.9 million in Q3 2025, revenue lower than before despite improvement ($200,000 in Q2).

- Financial challenges: Share price down to $0.37, with long-term negative forecast (0 dollars by 2030).

- Initial stage: Commercial launch by 2026, resulting in higher risk.

- Market competition: Volatility in the biotech sector and reduced demand post-pandemic.

According to Torigo’s 2025 SWOT analysis, the company has 3 strengths (innovative technology) and 4 weaknesses (financial loss)

CODX Stock Total Returns (Price Appreciation) Till December 3, 2025

CODX Stock Price Forecast 2026 to 2030 and analyst forecasts

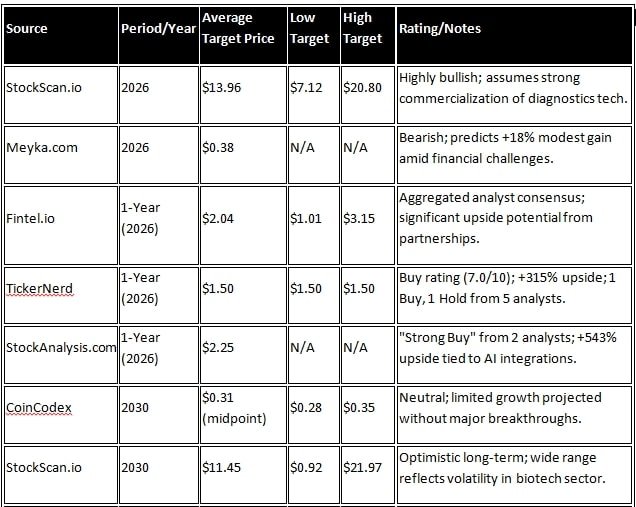

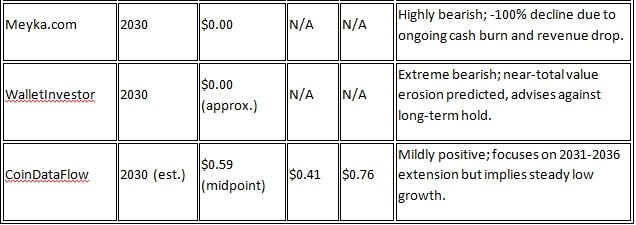

Codex share’s long-term forecast is mixed, depending on the commercial success of the company’s PCR platform. According to Stockscan.io, positive growth is expected by 2026, but long-term growth of +929% is projected by 2045. Sources like Meiyka.com, however, depict a negative picture; a forecast of $0.38 (+17.64% change) in 2026 and $0.00 (-100% change) in 2030 is based on revenue decline.

According to CoinCodex, the CODX Stock Price Forecast for 2030 will range from $0.2793 to $0.3457, which is moderate. CoinDataFlow has projected $0.41 to $0.76 for 2031-2036. Wall Street analysts are more optimistic. According to Fintel.io, the one-year average target price (by 2026) is $2.04, with a range of $1.01 to $3.15. Ticker Nerd has set a median target of $1.50 for 2026 and given a ‘Buy’ rating (7.0/10), indicating a 315% increase from the current price. On StockAnalysis.com, 2 analysts have given a ‘Strong Buy’ rating, with an average target of $2.25, expecting a 543% increase.

Sources like WalletInvestor are negative for long-term investment due to revenue volatility. Overall, analysts are giving a ‘strong buy’ rating because growth is likely from clinical trials and joint ventures. However, considering the risks in the biotech sector, a range of $1-3 in 2026 and $0-0.76 in 2030 is expected. Investors should monitor the company’s Q4 2025 earnings.

Conclusion

Codex stock could range from 0 to 3 dollars between 2026-2030, with analysts’ optimistic forecasts depending on the success of the PCR platform. Low debt and FDA policies are positive, but revenue decline and trial risk are negative. Investors should monitor the company’s JV updates and FDA submissions. This information is general; seek professional advice.

Disclaimer | This is not financial advice. Share prices are volatile and the market is subject to risks. Seek the assistance of a professional advisor before investing.