ATOS Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 03 December 2025, ATOS Stock Price Forecast News │ Atossa Therapeutics Inc. (NASDAQ: ATOS), a key player in the US biotech sector, focuses on developing new drugs for the treatment and prevention of breast cancer. The company is developing a new generation of selective estrogen receptor modulators (SERMs) such as (Z)-endoxifen, which could revolutionize risk assessment and treatment in breast cancer. By 2025, the company has approximately $65.1 million in cash, but it has not generated any revenue yet. This article will discuss ATOS stock price forecast from 2026 to 2030 (Best Penny Stocks to Buy), US stock market analysts’ predictions, the company’s total debt, future plans, relevant US government policies, and the company’s positives and negatives.

Total debt of Atossa Therapeutics Inc.

Atossa Therapeutics Inc. is a debt-free company, which is a significant positive indicator for its financial health. As of the end of the third quarter of 2025 (September 2025), the company’s total debt is zero (0 dollars). According to Yahoo Finance and PitchBook data, the total debt for the trailing twelve months (TTM) is 0. At the end of the first quarter of 2025, the company also had no debt and had cash of 65.1 million dollars. However, total liabilities are approximately 6.82 million dollars, which include operational expenses. This debt-free position enables the company to raise funds for clinical trials and focus on development.

The Atossa Therapeutics Inc. company’s future plans

Atossa Therapeutics Inc.’s future plans are primarily focused on (Z)-Endoxifen, which will be used for various stages of breast cancer. In the third quarter of 2025, the company received initial feedback from the Federal Food and Drug Administration (FDA), based on the regulatory pathway for metastatic breast cancer. The main plans are as follows:

- Phase 2 study for metastatic breast cancer: The IND (Investigational New Drug) application will be filed in Q4 2025. Patient enrolment will begin in 2026 and topline data is expected by the end of 2026.

- EVANGELINE Clinical Trial: This trial has been well-organized, with priority given to activities enabling NDA (New Drug Application) in 2026.

- Regulatory strategy for low-dose (Z)-endoxifen: plan to develop a low-dose version to reduce the risk of breast cancer, with discussions with the FDA continuing until 2026.

- Adjuvant breast cancer and other indications: Discussions are ongoing with the FDA, with updates to be shared in 2026. The company has shifted focus to new areas such as tumor reduction before surgery.

These schemes will enable the company to progress based on clinical data and regulatory approvals by 2026-2030.

The policies of the US government related to excessive production

The US government, particularly the FDA and the US Preventive Services Task Force (USPSTF), implements strict policies for the treatment and screening of breast cancer. Some key policies directly related to the production of Atossa include:

FDA regulations under the Mammography Quality Standards Act (MQSA): From September 2024, the FDA has mandated breast density notification, which has been strongly supported. This improves the assessment of breast cancer risk and is favourable for risk-reducing products such as Atossa’s (Z)-Endoxifen.

- USPSTF Guidelines: In May 2024, the USPSTF issued new guidelines for breast cancer screening, which received strong support. It recommends regular mammography for women over 40, which may increase the demand for preventive products.

- FDA Regulatory Pathway: Atossa Therapeutics Inc. has developed a regulatory strategy for low-dose (Z)-endoxifen to mitigate risks with the FDA starting June 2025. In July 2025, positive FDA feedback was received for ER+/HER2- metastatic breast cancer, paving the way for IND filing. In March 2025, an efficient regulatory pathway was recommended for metastatic indications.

These policies will help bring Atossa’s products to the market and obtain approval, but there is a need to validate clinical data.

Positive and negative aspects of Atossa Therapeutics Inc.

As Atosha is a clinical-stage company, its SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis contains both opportunities and risks.

Positive aspects (Strengths):

- New pipeline and FDA collaboration: Proprietary platform-based products such as (Z)-Endoxifen, which have 3 new patents. Positive feedback has been received from the FDA, which will aid in rapid progress for metastatic breast cancer.

- Debt-free and strong cash position: $65 million in cash, providing funding available for trials.

- Focused approach: Concentrated on breast cancer, providing a clear position in the market. Experienced management team.

- Market opportunity: Due to the increasing incidence of breast cancer (particularly because of USPSTF guidelines), the demand for products will rise.

Negative Aspects (Weaknesses):

Zero revenue and high expenses: Revenue is zero in 2025, while operational expenses are rising (7.4 million dollars in Q1 2025).

- Clinical risk: Dependence on a single product (single-product risk), valuation will decline in case of trial failure.

- Financial sustainability: The likelihood of cash depletion, which would necessitate raising additional funds.

- Market competition: Competition with other biotech companies and regulatory challenges.

ATOS Stock Price Forecast 2026 to 2030: From Analysts’ Perspective

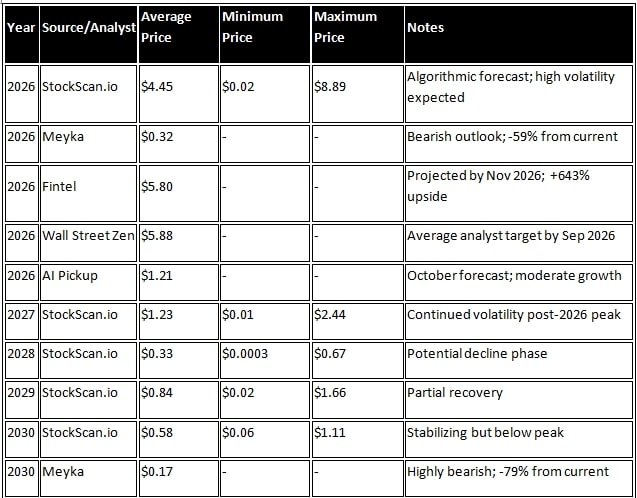

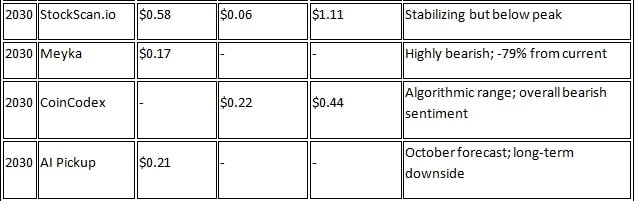

The current price of ATOS stock in the US stock market (as of December 2025) is approximately $0.70, making this company highly volatile and high-risk. Being dependent on the success or failure of clinical trials in the biotech sector, there is considerable variation in price forecasts from 2026 to 2030. Some analysts are optimistic while others are pessimistic.

ATOS Stock Price Forecast 2026

According to StocksCan.io, the average price will be $4.453, with a maximum of $8.886 and a minimum of $0.02. According to Wall Street Zen, it could reach an average of $5.88 by September 2026. However, according to Mayaka.com forecasts, this price could drop to $0.32, indicating a 59.11% decline.

ATOS Stock Price Forecast 2030

According to CoindCodex, ATOS shares are expected to range between $0.2234 and $0.4381. According to the pessimistic outlook of Meyka.com, it may decline to $0.17 by 2030, which is a decrease of 78.69%. Overall, analysts have an overall rating of “Strong Buy” with an average target price of $6.25, indicating an increase of 792.73% from the current price (stockanalysis.com). According to Fintel.io, the one-year average target is $5.80, with a range of $4.04 to $8.14.

These estimates depend on the success of clinical trials. If the trials of (Z)-Endoxifen are successful, the price will rise, otherwise it will decline.

Conclusion

Atossa Therapeutics Inc. is a high-risk, high-reward company. Investors should monitor clinical data and FDA approvals. Future success could elevate ATOS shares, but caution is advised. For more information, visit the company’s official website.

Disclaimer | This is not financial advice. Share prices are volatile and the market is subject to risks. Seek the assistance of a professional advisor before investing.