DNN Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 04 December 2025, DNN Stock Price Forecast News │ Denison Mines Corp. (NYSEAMERICAN: DNN) is a leading uranium mining, development, and exploration company in Canada, primarily operating in the Athabasca Basin region of northern Saskatchewan. The company focuses on opportunities in uranium production and the nuclear energy sector. By 2025, although DNN stock price (Best Penny Stocks to Buy) has experienced fluctuations, investor interest is increasing due to the global energy transition and the revival of nuclear energy.

This article will discuss DNN stock price prediction 2026 to 2030, opinions of US stock market analysts, the company’s positive and negative aspects, plans, investment returns over the past five years, and US government uranium-related policies.

Future plans of Dennison Mines Corp.

Dennison has focused on projects in the Athabasca Basin. Key plans:

- Wheeler River Uranium Project: With 95% ownership, it is the largest undeveloped uranium project in the world. A public hearing was held in 2025, and production is expected to begin by 2028.

- Midwest Project: Conceptual study for ISR (In-Situ Recovery) technology completed, progress in 2026.

- Moore Uranium Project: Sale to Skyharbor Resources, resulting in a new partnership.

- Domestic Agreement: Metis Nation-Saskatchewan and NexGen Energy negotiated an impact benefit agreement, ensuring environmental rehabilitation and sustainability. Overall, the company will focus on increasing production from 2026 to 2030.

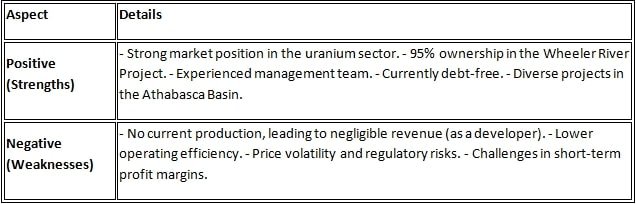

The positive and negative aspects of Denison Mines Corp.

The SWOT analysis of Denison Mines is as follows:

According to GlobalData, strict Canadian regulations are a risk, whereas increased uranium production is an opportunity. According to Artificial, a strong market and projects are the main positives.

Return received to Denison Mines Corp’s investors in the past 5 years

From December 2020 to December 2025, Denison Mines Corp provided investors with remarkable returns. According to Polygon data, the initial price was $0.4586, while the final price was $2.705, resulting in a total return of 489.84%. According to FinanceCharts, it was 561.42% over 5 years, and according to Yahoo, 609.43% in CAD. This was made possible due to the rise in uranium prices, which included a 136.48% return over 3 years and a 16.77% return over 1 year. According to SimplyWallSt, there was a 429% increase in the Russell Index five years after inclusion.

The United States government’s uranium and nuclear energy policies

In 2025, the US government declared uranium a ‘critical mineral’, thereby gaining strategic priority. President Trump’s four executive orders in May 2025 focused on revitalizing the nuclear industrial base.

- Quadruple nuclear capacity by 2050

- Increasing domestic uranium processing and enrichment (plan until September 2025).

- Rapidly develop advanced nuclear reactor technology

- Restrictions on Russian uranium imports and $3.4 billion funding for the supply chain.

- This policy is beneficial for companies like DNN as it promotes domestic production.

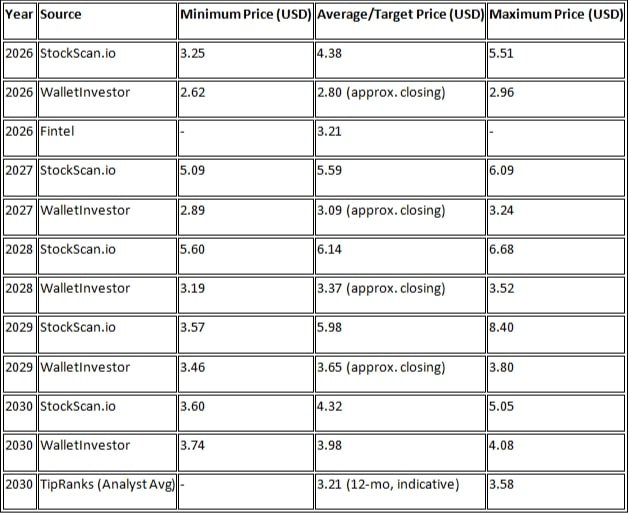

DNN Stock Price Forecast 2026 to 2030

Long-term forecasts of DNN stock price vary across different sources, depending on global uranium demand, geopolitical tensions, and nuclear energy policies. While most forecasts are positive, some indicate a slowdown.

DNN Stock Price Forecast 2026

According to StockScan.io, the average price may range from $2.50 to $3.00, whereas MeYaka.com estimates $2.21 (a decline of 18.72%). Fintel forecasts $3.21 by November 2026. Gaw Capital predicts $2.252.

DNN Stock Price Forecast 2030

According to StockScan.io, the average is $4.32 (high $5.05, low $3.60). According to Mayka.com, $3.35 (23.28% increase). According to WalletInvestor, a 53.43% return in 5 years (a $100 investment will become $153.43). Discussions on Reddit suggest $7-9 in a bull run, while post-2030, more than $15 is possible. Gov.Capital predicts a bearish estimate of $1.997.

Overall, the estimates range between $2 and $5, with the potential for uranium prices to rise in 2026. According to Tickerner, the average target is $3.76.

Opinion of American stock market analysts

American analysts view DNN positively, particularly due to the rising demand for uranium. According to TipRanks, five analysts have set an average 12-month target of $3.21 (high $3.55, low $3.00). According to Benzinga, four analysts have an average target of $2.73, with CIBC assigning $3.25. Roth MKM has given a $2.60 target with a ‘buy’ rating, mentioning an increase in uranium prices in 2026.

According to the chart, 15 analysts have given an average target of $3.21, indicating a 23.83% increase over the current price. According to stock analysis, the EPS is expected to be $-0.07 for 2025 and likely to turn positive by 2030. Overall, there is a ‘Moderate Buy’ rating, based on the growth of nuclear energy.

Conclusion

DNN Stock price is likely to increase between 2026 and 2030, particularly due to analysts’ ‘buy’ ratings and US policies. The company’s strong projects and debt-free position are positive, yet risks will persist until production commences. A 500%+ return over the past five years will motivate investors. Market research is necessary before investing.

Disclaimer | This is not financial advice. Stock prices are volatile, and the market is subject to risks. Seek the assistance of a professional advisor before investing.