BURU Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 05 December 2025, BURU Stock Price Forecast News │ Nuburu Inc. is an American technology company that develops high-power blue laser technology. The company primarily provides this technology for metal welding, 3D printing, and electric vehicle battery production. The shares of this company, trading under the ticker BURU (NYSEAMERICAN: BURU) on the NYSE American, are currently highly volatile and are considered penny stocks.

By 2025, Nuburu Inc. will have adopted a strategy to pivot towards the defense sector, offering potential future growth. This article provides a detailed discussion on the projected price of BURU stock from 2026 to 2030, analyst predictions, the Nuburu Inc. company’s (Penny Stocks to Buy) strengths and weaknesses, plans, returns to investors, and the impact of US government policies. This information is based on various reliable sources and has been prepared considering the situation up to 5 December 2025.

Advantages and disadvantages of Nuburu Inc.

The advantages and disadvantages of Nuburu Inc.’s investment are as follows:

Advantages (Pros):

- New Technology: Blue laser technology increases productivity in copper welding by 10 times, which is ideal for EV batteries and electronics.

- Growth in the defense sector: Partnership with US DOD and NATO, providing access to a 500 billion dollar market. Billing of 500,000 dollars expected in Q4 2025.

- Acquisitions and Financing: Acquisitions of companies such as Orbit S.r.l. and Tekne S.p.A., which will increase revenue.

- High growth potential: The long-term advantage due to patents and products (NUBURU BL™ and BL-F™).

Disadvantages (Cons):

- Revenue and Loss: In 2025, revenue $0.2 million, a 78% decline; massive loss (-22,688% net margin).

- Volatility and flattening: Share price experiences extreme fluctuations; pressure from dilution and reduced cash.

- Negative indicator: AI score 3/10; violation of NYSE regulations.

- Market Challenges: Slow Growth and Competition

Future plans of Nuburu Inc.

In 2025, Nuburu launched the ‘Transformation Plan’, which features a dual-CEO structure: one CEO focuses on defense, the other on the Blue Laser business. Key plans:

- Defense expansion: Nuburu Defence to achieve $500,000 billing in Q4 2025; progressive growth in 2026. Completion of Orbit and Tekne acquisitions, leading to the development of electronic warfare and anti-drone systems.

- Blue Laser Revival: expanding production lines, international partnerships, and $100 million SEC registration.

- Revenue target: $500 billion in the defence and EV markets by 2026-2030; expansion of blue lasers for 3D printing.

- Regulatory compliance: Restoring NYSE compliance and increasing capital.

The total return given to investors by Nuburu Inc.

Investors in Nuburu Inc. have suffered significant losses so far. According to Yahoo Finance, the YTD (2025) return is negative and considerably below the S&P 500. Key statistics:

- Shareholder yield: -2,788.70% (5 years).

- Return on Assets: -393.68%.

- Total shareholders’ equity: -53.86 million dollars; book value per share -0.26 dollars.

- 5-year TSR (Total Shareholder Return): Over approximately -90% decline, as the company’s stock price fell from $10 to $0.20 since the IPO (2023). No dividends, losses solely due to price drop.

Impact of American government policies on Nuburu Inc.’s product/service

The policies of the American government are favorable to Newbury’s laser technology, particularly in the defense and manufacturing sectors. Under the CHIPS Act and National Defense Authorization Act (NDAA), domestic laser production is encouraged, resulting in Newbury securing a place on the US DOD’s JQR list (2023). The SBIR award provided funding for anti-drone systems. The Italian government’s “Golden Power” policy delayed acquisitions, but US policies (such as Buy American) benefit the company. Overall, the policies encourage production growth, but regulatory compliance (such as NYSE warnings) remains a challenge.

BURU Stock Price Forecast 2026 to 2030

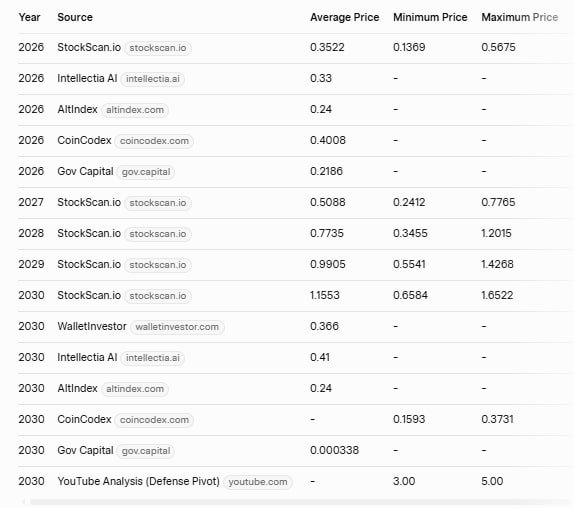

The price of BURU shares is based on estimates from various algorithmic models and market analyses. There are some positive forecasts due to the company’s growth in the defence sector and the demand for laser technology, while there are also some negative predictions due to economic instability. The table below summarises the key estimates:

Overall, most estimates are in the range of $0.20 to $0.50, but due to defense agreements (such as NATO and the US DOD), some sources expect an increase of up to $3-5. By 2026, the price is likely to stabilize at $0.30 to $0.40, while there is potential for an increase by 2030 if the company grows its revenue.

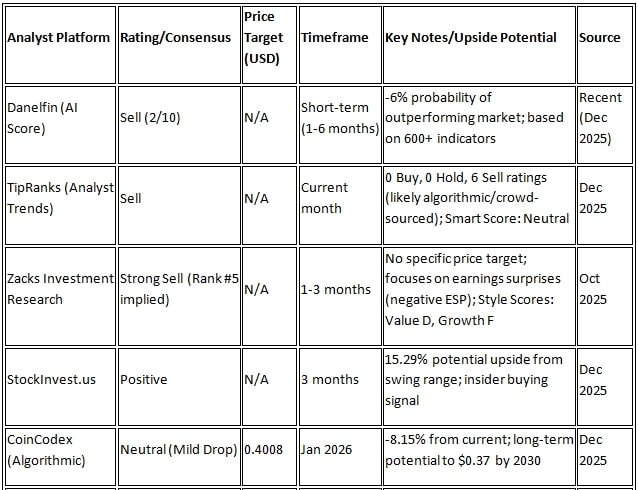

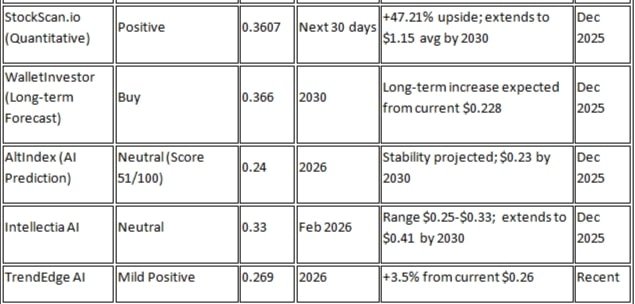

BURU Stock Price Predictions by American stock market analysts

American stock market analysts (such as Zacks, Danelfin) currently give BURU a “sell” rating due to the company having no revenue and a higher risk of losses. According to Zacks, there is no recommendation from any major brokerage. Danelfin’s AI score indicates a likelihood of underperforming the market by -6.55%. However, platforms such as AltIndex forecast $0.23 for 2026. According to StockInvest.us, a 14.54% increase is expected over the next three months, but caution is advised in the long term. Overall, analyst sentiment is mixed: positive due to growth in the defense sector, but negative due to economic weakness.

Conclusion

BURU stock could brighten from 2026 to 2030 due to increased protection, but the risk is high. Investors should seek independent advice. If Nuburu Inc.’s new strategy proves successful, this company could become a major player in laser technology.

Disclaimer | This is not financial advice. Stock prices are volatile, and the market is subject to risks. Seek the assistance of a professional advisor before investing.