ASST Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 10 December 2025: Strive Inc., (NASDAQ: ASST) formerly known as Asset Entities Inc., is a newly publicly traded company established in 2025 through a merger with Strive Asset Management. This company is recognized as the world’s first publicly held Bitcoin treasury company, focusing on digital assets such as Bitcoin. The current price of its shares on NASDAQ, under the ticker symbol ASST (Penny Stocks to Buy Now), is approximately $0.95 as of 10 December 2025, which is significantly below the 52-week high of $13.42. The company, under the leadership of Vivek Ramaswamy, is known for its ‘anti-woke’ and shareholder-focused investment strategies.

This article will provide a detailed discussion on the projected price of ASST shares from 2026 to 2030, the predictions of American analysts, the advantages and disadvantages of Strive Inc., plans, overall returns for investors, and the impact of U.S. government policies.

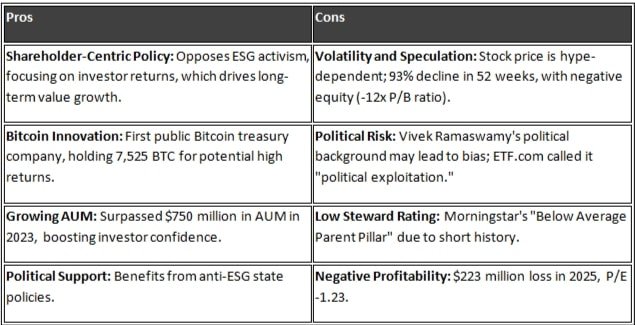

Strive Inc. Pros and Cons

Strive Inc. is a company known for its ‘anti-ESG’ (Environmental, Social, and Governance) approach, which prioritizes the interests of shareholders. The table below outlines the advantages and disadvantages:

Plans of Strive Inc.

Strive Inc.’s plan is focused on Bitcoin expansion. In 2025, the company launched a $500 million ATM (At-The-Market) offering, which will enable further Bitcoin purchases and share buybacks. The main plan:

- Bitcoin increase: 1,567 BTC (average $103,315) purchased; target to hold 10,000 BTC by the end of 2025.

- Merger: Merger with Semler Scientific Inc., which will complement the Bitcoin strategy.

- Preferred equity: Issued publicly traded perpetual preferred equity in 2025, raising 160 million dollars.

- Index impact: Request to MSCI via letter not to exclude Bitcoin Treasury from the index.

- Fund allocation: Using funds for Bitcoin purchases, income-generating assets, and share buybacks.

These schemes will increase the company’s Bitcoin per share, leading to an expected strong position by 2030.

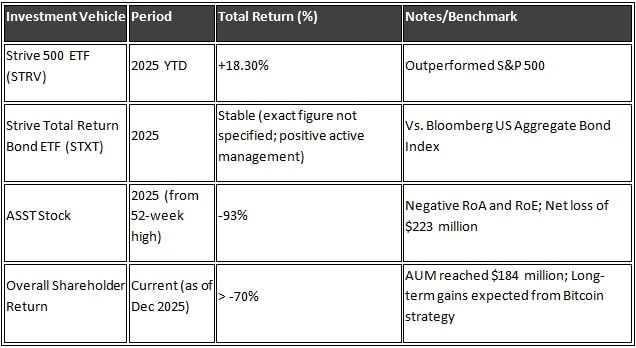

Total return provided to investors by Strive Inc.

Investors have received mixed returns through Strive Inc.’s ETFs and shares.

ETF Returns: Strive 500 ETF (STRV) delivered a YTD return of 18.30% in 2025, outperforming the S&P 500. Strive Total Return Bond ETF (STXT) provided stable returns through active management against the Bloomberg US Aggregate Bond Index.

ASST stock return: However, negative returns through shares; a 93% decline from the peak in 2025. The company’s RoA and RoE are negative, with a profit of -$223 million. AUM has reached $184 million, but the total return for shareholders is currently more than -70%. Improvements are expected for long-term investors due to the Bitcoin strategy.

Influence of the American government on policy and Strive Inc.

The policies of the American government have both positive and negative effects on Strive’s products (ETF and Bitcoin Treasury).

- Crypto regulations: The new provision to mark digital assets at fair value under GAAP rules is beneficial for Bitcoin holders, helping Strive with valuation.

- Anti-ESG policy: In some states, anti-ESG laws (e.g., state funds banned from ESG) benefit Strive’s ‘anti-woke’ ETF, leading to an increase in AUM. According to Fox Business, ESG reduced investor returns, giving Strive a market advantage.

- SEC impact: Strive commented on SEC regulations regarding AI-related advice, which could impose restrictions on investment counsel. It commented on Musk’s law in the Supreme Court, which could affect corporate governance.

- Risk: Losses may occur if crypto regulation becomes strict (e.g., MSCI excluding Bitcoin), but Strive opposed this. Overall, political changes (Crypto support during the Trump era) will be beneficial for Strive.

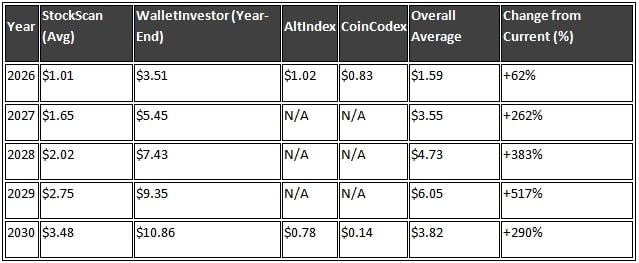

ASST Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

The estimated price of ASST shares depends on the company’s Bitcoin-focused strategy, which makes it highly volatile. Leading analysts and platforms in the US stock market have made various predictions for the period from 2026 to 2030. These estimates are based on market trends, economic conditions, the price of Bitcoin, and the company’s expansion. The table below summarizes the key estimates:

Summary of analysts’ opinions:

Negative short-term outlook:

According to StockScan.io, the share price could fall to $0.69 over the next 30 days, resulting in a 32% decline. According to CoinCodex projections, there will be a 3.59% decline by January 2026.

Positive long-term outlook:

Platforms like WalletInvestor have projected a value of $10.86 by 2030, based on Bitcoin’s growth. Intellectia AI has forecasted $4.90 for 2030, with long-term growth expected due to the company’s Bitcoin strategy. According to analysts on LinkedIn, strong growth is anticipated by 2030 due to market trends and the company’s latest mergers. Overall, analysts rely on Bitcoin’s price (which could reach $100,000 by 2030), but the company’s volatility increases risk.

Conclusion

ASST stocks will remain dependent on the growth of Bitcoin from 2026 to 2030, with analysts showing a positive long-term outlook. Although Strive Inc.’s restructuring is attractive, the risk is high. Investors should study market trends and strategies. This information is up to 10 December 2025; contact a professional advisor for updated advice.