NFE Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 09 December 2025, NFE News: New Fortress Energy Inc. (NASDAQ: NFE) is a leading liquefied natural gas (LNG) company operating in the energy supply, transportation, and electricity generation sectors. The company primarily develops LNG-based power plants and infrastructure in Latin America, the Caribbean, and Europe. By 2025, NFE’s stock price (Penny Stocks to buy now) had dropped by more than 90% over the year, and the company faces challenges due to a substantial debt burden (approximately $9 billion) and regulatory hurdles.

In this article, we will provide a detailed discussion on the projected NFE stock price forecast for 2026 to 2030, by American stock market analysts, the company’s strengths and weaknesses, plans, total returns provided to investors, and the impact of American government policies. This analysis is based on data available as of December 2025.

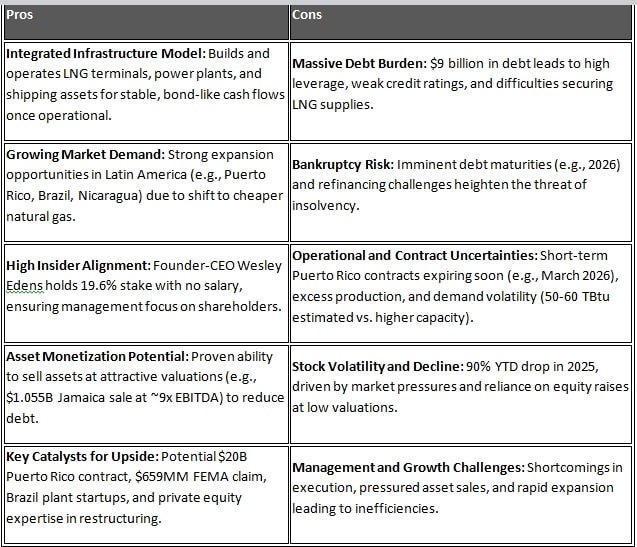

Advantages and Disadvantages of New Fortress Energy Inc.

As NFE is an integrated company in the LNG sector, it has several strong points, but the financial challenges are equally significant. The comparison is given in the table below:

According to sources, the company’s LNG-based clean energy policies are beneficial in the long term, but immediate financial pressures exacerbate the losses.

Future plans of New Fortress Energy Inc.

NFE’s plans focus on the expansion of LNG infrastructure, with new projects expected to commence in 2025-2026. The main plans are as follows:

- Power Plant Expansion: The first fire has been achieved at the CELBA 2 power plant, and the PortoCem plant is 75% complete and will be operational by August 2026. These plants will provide a stable electricity supply in Latin America.

- Puerto Rico agreement: Secured a 7-year, 75 TBtu gas supply contract, which will enhance grid stability and reduce emissions. The company sold emergency power plants built for the US Army Corps of Engineers to PREPA for $373 million.

- Fast LNG platform: Rapidly increase exports through floating, modular liquefaction systems, enabling new market entry.

- Debt restructuring: Credit agreements have been revised, extending the term until March 2026, providing temporary liquidity. S&P Global has upgraded the rating to ‘CCC-‘.

- New Market: According to PESTEL analysis, expansion into new markets, energy technology innovations, and strategic planning, including participation in auctions up to 15 GW.

These schemes are likely to increase Adjusted EBITDA to 313 million dollars by 2026.

Total return provided to investors (Total Shareholder Return)

The return provided by NFE to investors has remained negative, affecting the confidence of shareholders. According to stock analysis:

- 1-year TSR: -87.59%

- YTD (2025): -410.81% (very sharp decline).

- 5-year TSR: -47.760%, with an average annual negative return.

- Shareholder yield: -464.20% (according to GuruFocus), lacking dividends or share buybacks.

Although the Adjusted EBITDA for the third quarter of 2024 was $313 million, the overall return remained negative. According to Simply Wall Street, the company has limited ability to provide consistent returns, making it suitable only for high-risk investors.

American government policy and its impact on NFE

US government policies directly affect LNG exports and infrastructure, bringing both advantages and challenges to NFE.

Positive impact:

The Trump administration expedited export permits for LNG terminals, granting NFE’s Fast LNG 1 project a 5-year export approval (DOE, 2024). Gas supply agreements with Puerto Rico are being implemented following governmental approval, contributing to reduced emissions and enhanced grid stability.

Negative impact:

The Biden administration’s LNG export policies caused difficulties, leading to price increases and affecting the domestic market. The DC Circuit Court determined that FERC review was required for NFE’s LNG terminal (2022), which delayed construction. Organizations such as Public Citizen opposed LNG exports, leading to higher energy costs for American families and making it difficult for NFE’s Latin American projects to secure LNG supply.

Overall impact:

Strategic changes pose regulatory challenges for the NFE, but if exports increase, revenue will rise. In 2025, Puerto Rico’s Federal Oversight Board rejected the gas deal, which slowed expansion.

NFE Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

The long-term outlook for NFE’s share price is mixed, with most analysts showing a negative perspective. The company’s high debt, difficulties in LNG supply, and market volatility may lead to a decrease in stock prices. Nevertheless, some optimistic forecasts are based on the company’s expansion plans.

NFE Stock Price Forecast 2026

According to Stockscan.io, the average price of NFE in 2026 will be $66.37, with a maximum of $85.46 and a minimum of $47.28. However, according to CoinCodex’s forecast, the stock is expected to drop to $1.56 by January 2026, indicating a decrease of 0.47%. On platforms such as Wallet Investor, the long-term forecast is extremely negative, suggesting the price could fall to $0.000001.

NFE Stock Price Forecast 2027 to 2030

According to Coindataflow, the price from 2026-2031 is expected to remain within the range of $1.09 to $1.31. On TradingView, the average one-year target price is $3.50, including a maximum of $8.50 and a minimum of $1.00. According to Fintel.io, the average one-year target is $4.39, with a range of $1.01 to $8.92. AI-based analysis, such as Intelectia AI predicts a decline in share price over the next 12 months. Overall, by 2030, the company may see a positive turn if debt restructuring and LNG exports increase; otherwise, the price is likely to remain within the $1 to $5 range.

These estimates will be significantly influenced by global LNG market demand, oil prices, and regulatory changes.

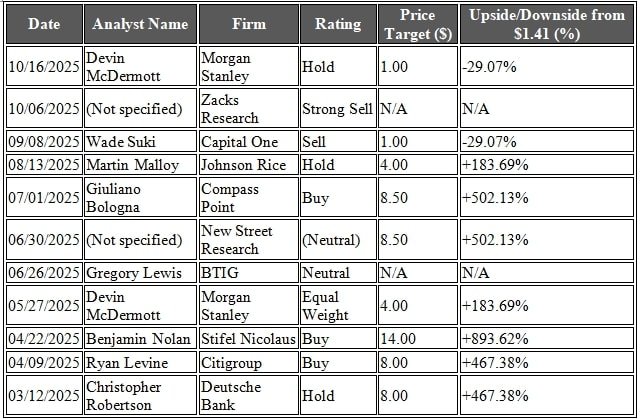

NFE Stock Price Prediction 2026 to 2030 by American stock market analysts

American stock market analysts consider NFE a high-risk share, which has significant upside potential, but current challenges are substantial. According to Yahoo Finance, analysts expect earnings and revenue growth, but the ‘sell’ rating is high due to debt. Seeking Alpha’s analysis indicates that the company faces a 90% YTD decline and a bankruptcy risk due to $9 billion of debt, yet future growth is possible thanks to LNG infrastructure.

The average 1-year target price by Wall Street analysts is in the range of 1 to 4 dollars, with most recommendations being ‘hold’ or ‘sell’. Institutions like Zacks Investment Research assign low ranks to the company’s style score, highlighting valuation and growth risks. Overall, analysts see 50% upside if the debt restructuring is successful by 2026; otherwise, further decline is expected.

Conclusion

NFE is a potentially promising company in the LNG sector, but due to high debt and regulatory risks, the share price is likely to remain within the range of 1 to 5 dollars between 2026 and 2030. Although analysts are negative, plans like PortoCem could bring a turnaround. Investors should make decisions considering the risks. The company’s overall returns have provided lessons, and government policies will be key to future success. Refer to reliable sources for further updates.