JBLU Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 09 December 2025: JetBlue Airways Corporation (NASDAQ: JBLU), a leading low-cost carrier in the United States, has faced numerous challenges in recent years. The post-COVID-19 recovery, rising fuel costs, and competitive pressures have led to significant fluctuations in the company’s share price. By December 2025, JBLU’s share price reached approximately $4.95, with an annual return of -28.59%. In this article, we will discuss in detail JBLU’s share price projections for the period 2026 to 2030, forecasts by American analysts, the company’s strengths and weaknesses, plans, total returns for investors, and the impact of American government policies.

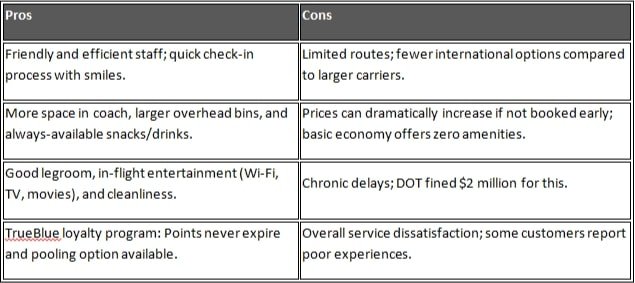

Advantages and Disadvantages of JetBlue Airways Corporation

JetBlue is a low-cost airline company known for its customer-oriented services. Its advantages and disadvantages are as follows:

Advantages (Pros):

- Efficient operations and customer-centric initiatives: The company’s network optimization and customer-friendly policies (such as free Wi-Fi and entertainment) provide a competitive advantage.

- Expansion plan: New routes from Fort Lauderdale and Latin America expansion.

- Technical signal: Buy signals from short and long-term moving averages.

- Low valuation: Price to sales ratio 0.2x, which is lower than the competitors’ 0.5x.

Disadvantages (Cons):

- High debt and weak financials: high leverage and continuous losses (losses in Q3 2025).

- Operational challenges: A $2 million fine from the DOT for flight delays.

- Negative earnings expectation: Loss of $1.54 per share for 2025.

- High capital expenditure: Significant costs for fleet acquisition and maintenance.

Future plans of JetBlue Airways Corporation

JetBlue has announced the ‘JetForward’ strategy, focusing on achieving profitability from 2025. The main plan:

- Route Expansion: From November 2025, 9 new non-stop routes from Fort Lauderdale (US, Latin America). Daily flights to Guatemala City from April 2025. New flights to Wilmington and Norfolk.

- Network optimization: reducing costs by cancelling over 50 routes and strengthening the East Coast network.

- Profitability focus: Progress in Q3 2025, but losses in Q2. Efforts towards ‘level playing field’ under the leadership of CEO Joana Geraghty.

Stability is expected by 2026 due to these schemes.

Total return provided to investors by JetBlue Airways Corporation

JBLU has provided investors with mixed returns. A $1,000 investment since the 2002 IPO has yielded -$641 (approximately -64.1%). A continuous decline over 10 years (-4.18% annually).

However, the 2025 YTD return is 37.02% (better than the S&P 500). Last year it was -29.77%. Overall, disappointing for long-term investors, but the short-term bounce (7% increase last week) is positive.

Impact of American government policies on JetBlue Airways Corporation’s products or services

American government policies have a significant impact on JBLU, particularly in the aviation sector.

- Shutdowns and Natural Disasters: The 2025 government shutdown resulted in a revenue loss of 500 million dollars and reduced bookings. Hurricane Melissa led to a decrease in Q4 capacity.

- Regulations and penalties: DOT imposed a 2 million dollar fine for delays. The Spirit merger was blocked by the DOJ, resulting in a loss of competitive advantage.

- Airport slot reforms: The CEO has called for improvements to airport access rules, which will make it easier to serve smaller cities. The ‘JetBlue effect’ has led other companies to offer fewer minor benefits to passengers due to advantages.

Overall, the policies have negative impacts, but the company is endeavoring to make improvements.

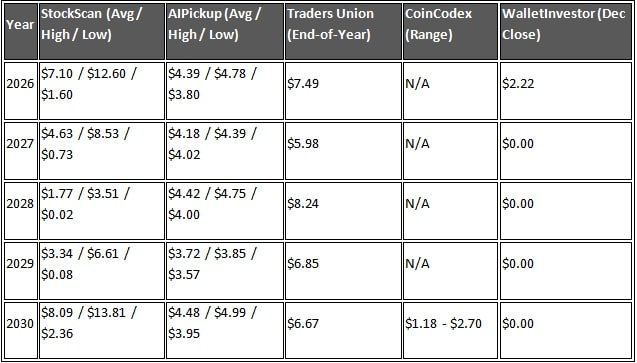

JBLU Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

The future price projections for JBLU shares are based on various sources, including algorithm-based models and market trends. Overall, the forecasts are mixed – some indicate potential positive growth, while others show negative trends. The main projections are as follows:

JBLU Stock Price Forecast 2026

According to CoinCodek, the share price is expected to increase by 3.09% to reach $4.94 by January 2026. According to AI Pickup’s estimate, it will be $4.65 in January and $3.81 by December. Gov. Capital’s estimate is $3.495.

JBLU Stock Price Forecast 2027 to 2028

According to StockScan’s model, the average price during this period will remain around 5-6 dollars, but sources like Wallet Investor indicate it is negative for long-term investment.

JBLU Stock Price Forecast 2030

StockScan: Average $8.0892, High $13.81, and Low $2.3639. AI Pickup: $4.38.

Overall, by 2030, the stock price is likely to remain in the range of 3 to 8 dollars, with fuel prices, demand growth, and competition being the key factors. However, most models anticipate stability or a decline rather than growth.

American stock market analysts’ JBLU stock price predictions for 2026 to 2030

American analysts (such as The Wall Street Journal, MarketWatch, and Yahoo Finance) give JBLU a ‘Reduce’ rating, which includes 6 Hold and 4 Sell ratings. The average price target is $4.44, with a high of $8.00 and a low of $3.00.

JBLU stock price predictions 2026 to 2027

According to Fintel, the yearly target is 95.99 Mexican pesos (approximately 5 USD), with an expected revenue growth of 12.75%. Intellectia AI: 4.42 USD in March 2026.

JBLU stock price predictions 2028 to 2030

Analysts expect negative earnings – a loss of $1.54 per share in 2025 and $0.75 in 2026.

StockScan: $3.8812 over 30 days. In the long term, analysts say the company’s high debts and operational challenges will limit growth.

Conclusion:

The period from 2026 to 2030 will be challenging for JBLU, but growth is possible with the JetForward strategy. Investors should make decisions considering the risks. This forecast depends on market changes.