ADM Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 15 December 2025: Archer-Daniels-Midland Company (NYSE: ADM) is a leading global agriculture and food processing company known for its handling of agricultural products. The forecast for ADM stock price from 2026 to 2030 (Penny Stocks to Buy now) is important for investors as the company’s presence across various sectors makes it susceptible to market fluctuations. In this article, we will have a detailed discussion on ADM’s share price predictions, analyst opinions, company strengths and weaknesses, future plans, returns for investors, and the impact of US government policies. This analysis is based on various reliable sources and can be used as a reference for investment decisions.

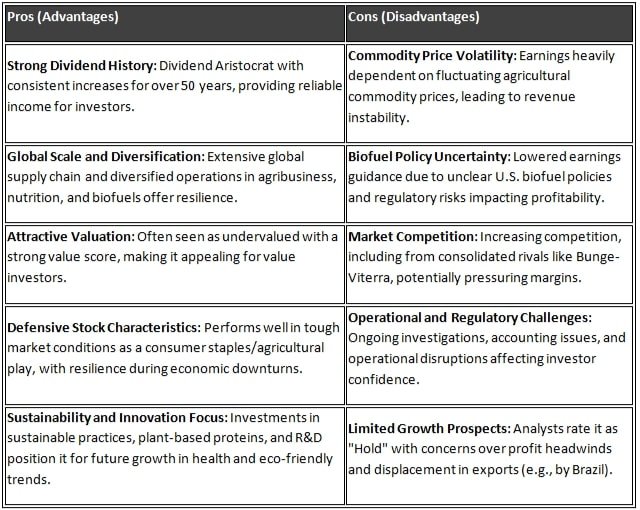

Pros and cons of ADM stock

The pros and cons of investing in ADM stock are as follows:

Company plans

ADM stock has focused on cutting costs beyond 2025. Spending cuts of 200-300 million dollars are expected for 2025, which will result in 700 job reductions. Over three to five years, savings of 500-750 million dollars are expected. The adjusted EPS guidance for 2025 has been lowered to 3.25-3.50 dollars from the previous 4.00 dollars. The company is focusing on environmental improvements and the biofuel sector, taking into account changes in China trade and policy. The previous EPS target of 6-7 dollars by 2025 has now been revised, with more emphasis on efficiency and innovation.

The total return given to investors by ADM stock

ADM stock has consistently delivered returns to investors. In the last 12 months, it gave a 17.28% return, which is higher than the S&P 500’s 14%. So far in 2025, it has grown by 21.37%. Over five years, the return is 32.26%, in 2022 it was 39.7%, and the three-year average is 28.9% (higher than peers). The dividend history is strong: 4.10% in 12 months, 8.94% in 36 months. This makes ADM appealing for long-term investment.

Impact of US government policies on Archer-Daniels-Midland Co

US government policies directly impact ADM’s products and services. Uncertainty in biofuel policy slows down the 2025 outlook, with risks of corn subsidies and policy changes. China’s soybean ban will affect exports. Under the Clean Air Act agreement, ADM will need to make improvements to cut 63,000 tons of pollution, increasing costs. DOJ audits and SEC investigations hit the company’s image. Political contributions ($435,927 in 2024) and lobbying ($3.65 million) aim to support policies that boost ADM’s growth. Trade tensions and agricultural bills bring both opportunities and risks for ADM.

ADM Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

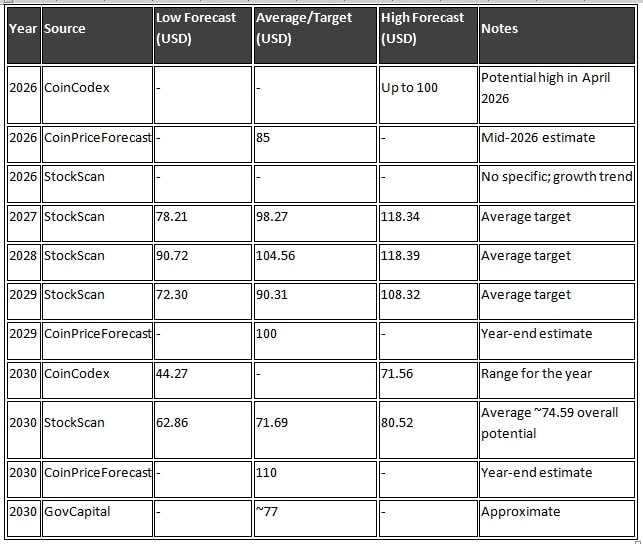

The long-term outlook for ADM’s share price is mixed, with some sources expecting positive growth while others are taking a cautious approach. From the current price (around $60), the expectation for 2026 is between $60 and $75, while by 2030 it could reach $70 to $90. These forecasts depend on the company’s cost management, business strategies and the prices of agricultural commodities.

ADM Stock Price Forecast 2026

According to CoinCodeX, ADM shares could rise by 8% to reach $64.80 by January 2026. AltIndex predicts this price will be limited to $61, while LongForecast expects an average of $73.35 in November 2026. However, Intellect predicts the price could drop to $46.13, indicating a downturn.

ADM Stock Price Forecast 2030

According to Stockscan.io, ADM shares could reach $74.59, while TradersUnion predicts $93.07 by 2029. Benzinga suggests there could be growth by 2030, especially due to tariffs and onshoring trends. However, StockAnalysis recommends ‘hold’, with an average target of $56.83.

These estimates can be affected by instability in the agricultural sector, like climate change and trade wars.

US stock market analysts’ predictions for ADM stock

US analysts give ADM a ‘hold’ rating, with an average target of $58.97 from six analysts (as of November 2026). According to Fintel, revenue is expected to grow by 29.76%, which would boost the stock price. However, despite Fitch Ratings keeping an ‘A’ rating, the outlook is ‘negative’ due to the likelihood of rising debt (1.8x by 2025). Benzinga is positive, expecting growth in AI-based projections through 2030. According to StocksCAN.io, a 176% increase is possible by 2045. Overall, analysts believe in long-term value but are cautious due to short-term risks.

Conclusion

ADM stock price is likely to be positive from 2026-2030, but volatility will remain. Strong dividends and cost control are advantages, while commodity prices and policy changes are drawbacks. The company’s plans are focused on efficiency, and historical returns attract investors. Government policies will shape ADM’s growth. Investors should make decisions after getting personal advice.