XRP Price Prediction 2026 To 2030 : What analysts says on target price?

New York, 25 November 2025 : The volatility and rapid changes in the cryptocurrency market have always been both attractive and risky for investors. By the end of 2025, as financial markets around the world are embracing digital assets, the role of cryptocurrencies like XRP has become more significant. XRP, based on the Ripple network, is a digital token designed for international payments. This article will inform readers about the potential of XRP in 2026, based on its price, the impact of ETFs and long-term forecasts. As of today (25 November 2025), XRP is trading around $2.00 to $2.50, having recorded an increase of over 500% in 2025.

What is XRP

XRP is a cryptocurrency developed by Ripple Labs, primarily used for international currency transfers and cross-border payments. The XRP Ledger (XRPL) is a decentralized, public blockchain, operated by a global community of businesses and developers. Its key features include fast transactions (within 3-5 seconds) and low fees (0.0001 USD per transaction), making it attractive for banks.

The Ripple network uses XRP for On-Demand Liquidity (ODL), which facilitates easier currency exchange between countries. Launched in 2012, XRP had partnered with over 100 countries by 2025. However, its growth slowed due to legal disputes with the SEC in the United States (2020-2023). In 2025, these disputes were resolved, and XRP was recognized as ‘not secure’, leading to an increase in its value.

The total supply of XRP is 100 billion tokens, of which 55 billion are held by Ripple. These tokens do not rely on mining like Bitcoin or Ethereum; instead, they are pre-mined, making them environmentally friendly.

XRP ETF

In November 2025, the approval of the XRP ETF became the biggest news in the crypto market. Grayscale XRP Trust ETF (GXRP) began trading on the NYSE Arca on 24 November 2025, enabling investors to invest directly in XRP. Additionally, the Bitwise XRP ETF (Ticker: XRP) commenced trading with a 0.34% management fee, and waived fees on $500 million in assets during the first month. ETFs from Franklin Templeton and other companies also received approval from the SEC on 21 November.

This was made possible by the ETF settling the SEC-Ripple dispute and the ‘auto-effective S-1’ framework. The result is an increase in institutional investment, creating the potential for XRP’s price to rise by 22%. By 2026, these ETFs will encourage adoption in the banking sector, increasing XRP’s utility and stabilizing its price. However, risks will persist due to market volatility.

XRP Price Prediction – Expectations for 2026

The year 2026 could be significant for XRP, as its growth is expected due to the ATF launch, regulatory clarity, and global economic pressures. Predictions from various analysts are as follows:

By the end of 2025, XRP is likely to reach $2.85, and in 2026 it could rise to between $4 and $10, especially in a bull market. Discussions on X (Twitter) also include predictions ranging from $10 to $100, with some users suggesting up to $500. However, these are overly optimistic. Realistically, a range of $4 to $8 in 2026 is more plausible, depending on ATF and banking adoption.

XRP price prediction $500

$500 is a very optimistic and controversial prediction for XRP. Some analysts and social media users (such as Wells Fargo’s 2023 Treasury Manager Shannon Thorpe) suggest a potential rise from $100 to $500, stating that this could happen within seven months. Some posts on X talk about $500 to $1,000, mentioning float scarcity and FOMO (Fear Of Missing Out).

However, most experts consider this unrealistic. Reaching $500 from the current $2 price would require a 25,000% increase, creating a $50 trillion market cap – twice the global GDP! According to sources like Cryptomas and TokenMetrics, $500 is not possible in the next 25 years. Achieving $50,000 from a $500 investment would require a 100x increase, which is possible from $25 to $170 by 2030, but not $500. This forecast is primarily based on hype, and actual growth will be limited to around $100.

XRP price prediction 2026

2026 could be a growth year for XRP, particularly due to the ATF launch and regulatory clarity. A price range of $4 to $10 is realistic, depending on banking adoption and global payments usage. While very high predictions like $500 are exciting, they are risky and unrealistic. Investors should consider market volatility, geopolitical risks, and diversification. XRP is a strong player in the crypto universe, but success is not guaranteed.

XRP Price Prediction for 2026 and 2030: A Comparison

2026 could mark the beginning of growth for XRP, while 2030 will represent a year of long-term stability and significant institutional adoption. The launch of the ETF and regulatory clarity in 2026 is expected to drive the price up to $4 to $10, whereas by 2030, global remittances, banking integration, and the maturation of the crypto market could see prices ranging from $5 to $25 or even higher. However, predictions for both years depend on market volatility, geopolitical risks, and events such as Bitcoin halving. The table below compares forecasts obtained from various sources.

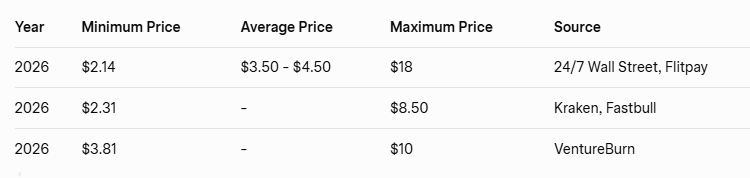

Comparative analysis:

Predictions for 2026 are more cautious ($2.14 to $18) as they are based on short-term events such as ATF and SEC clarity. In contrast, expectations for 2030 are more optimistic ($2.66 to $50), with sources like Fleetpe mentioning up to $50, while Forbes gives a balanced average of $5.25. Analysts like Motley Fool consider an increase up to $6 possible, which is double the $4-8 range of 2026. However, some sources (such as Kraken at $2.81) remain cautious as extremely high predictions like $1000 are mathematically impossible – XRP’s market cap cannot exceed the entire crypto market.

Overall, by 2030, a 2-5 fold increase compared to 2026 is possible if XRP achieves 100% adoption in international payments. Investors should consider this risky and ensure diversification.

Advice: Cryptocurrency investment is risky; conduct independent research and seek the help of a financial advisor. (Source: Various analyses and market data, up to 25 November 2025).