Bitcoin Price Prediction 2026 To 2030 : Here is the analyst’s opinion

New York, 27 November 2025 : Bitcoin (BTC), the first and largest digital currency in the world of cryptocurrency, is not merely an investment vehicle but a symbol of digital gold. Developed by Satoshi Nakamoto in 2009, this technology has revolutionized decentralized finance and the global economy. As of 27 November 2025, the price of Bitcoin is trading around 91,222 dollars. However, based on future price projections, Bitcoin is expected to see significant increases between 2026 and 2030.

These forecasts are based on various market analysts, algorithmic models, halving cycles, and fundamental factors. In this article, we will discuss detailed forecasts of Bitcoin prices, including predictions by American market analysts. While these forecasts involve risk, they are based on market trends, institutional adoption, and global economic conditions.

Key factors affecting Bitcoin prices

The price of Bitcoin depends on several factors:

Halving Events: Following the 2024 halving, the reduction in supply could lead to a price increase. The next halving is expected in 2028.

ETF and Institutional Investment: Following the approval of the Bitcoin ETF by the SEC in the United States, inflows increased in 2025. The ETF market is likely to reach 1 trillion dollars by 2030.

Global adoption: Countries and companies (such as Tesla, Microsoft) are accepting Bitcoin. The development of Web3 and CBDCs will increase demand.

Regulation and economic factors: Interest rates of the American Federal Reserve, inflation, and geopolitical tensions affect the market. In a bull market, the price of BTC can double.

Competition and risks: Alternatives like Ethereum or Solana pose challenges, but Bitcoin’s ‘store of value’ status remains strong.

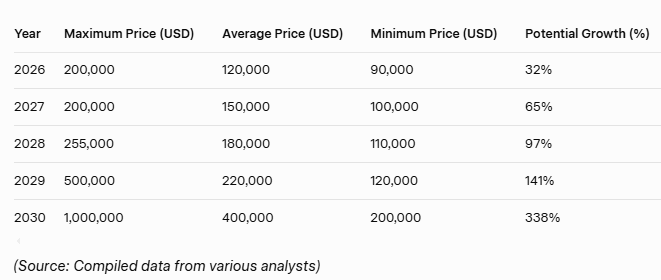

Based on these factors, there are various projections from different sources for 2026 to 2030. Some are conservative, while others are highly optimistic.

Bitcoin price forecast 2026

2026 will mark the midpoint of the halving cycle for Bitcoin, when the full impact of ETFs will be seen and adoption will increase. According to market analysts:

Binance: $95,073

CoinCodex: $89,932 to $98,000.

Investing Heaven: $99,910 to $200,000.

Traders Union: $128,909 at year-end.

CoinDCX: $105,000 to $135,000.

Axie (CoinCodex Algorithm): $109,591.

Arthur Hage (FleetPay): $750,000 (highly optimistic).

Average estimate: $100,000 to $150,000. This represents an increase of 10% to 65% compared to 2025 prices. If ETF inflows and the halving effect continue, there is a possibility of surpassing $200,000.

Bitcoin price forecast 2027

By 2027, the Bitcoin ecosystem will become more mature, particularly due to institutional investment. Forecast:

Binance: $99,826.

Bybit: $182,249

Investing Heaven: More than $200,000.

Traders Union: $102,902 at the end of the year.

Crypto news (Axie): $202,881.

Average: $120,000 to $200,000. This year will show steady growth, but market fluctuations are possible.

Bitcoin price forecast 2028

2028 will be the year of the next halving, which will cause a supply shock and drive the price up. Forecast:

Binance: $104,818

Bybit: $212,291

Investing heaven: $255,000.

Traders Union: $113,894 at the end of the year.

Average: $130,000 to $250,000. A significant increase expected due to halving.

Bitcoin price forecast 2029

By 2029, Bitcoin will become a part of the mainstream financial system. Predictions:

Bybit: $246,550

Investing Heaven: $277,000.

Traders Union: $112,207 at the end of the year.

Bitwise (AXY): $1,000,000.

Standard Chartered: $500,000.

Average: $150,000 to $300,000.

Bitcoin price forecast 2030

2030 will be the year of maturity for Bitcoin, when it will become a global reserve asset. Predictions:

CoinCodex: $276,001 to $308,158.

Bybit: $276,042

Investing Haven: $180,000 to $300,000.

Van: $300,000

ARK Invest: Bear $300,000, Base $710,000, Bull $1,500,000.

Yahoo Finance: $300,000.

Fleetpay: $1,000,000.

Tom Lee (Fundstrat): $3,000,000.

Average: $200,000 to $500,000. This represents an increase of 120% to 448% compared to 2025 prices. In an optimistic scenario, it could exceed 1 million.

Forecast of American market analysts from 2026 to 2030

American investment firms are adopting a positive outlook towards Bitcoin, particularly due to ETFs and corporate treasury adoption.

ARK Invest: Bear $300,000, Base $710,000, Bull $1,500,000 for 2030. This is based on DeFi, remittances, and store of value.

Vannek: $300,000 by 2030, long-term 1 million.

Bitwise: 1 million dollars by 2029.

Fundstrat (Tom Lee): 3 million dollars by 2030, due to halving and ETF growth.

Yahoo Finance Analyst: $300,000 by 2030, triple increase.

According to these forecasts, American analysts expect $100,000 to $200,000 for 2026 and $300,000 to over $1 million for 2030. This regulation depends on clarity and economic stability.

Conclusion and Risk

The price of Bitcoin is likely to reach from $90,000 to over $500,000 between 2026 and 2030, making it a potentially excellent long-term investment. Optimistic perspectives from American analysts have generated enthusiasm in the market. However, the crypto market is volatile – regulations, geopolitical risks, or economic downturns could cause declines. Conduct independent research and seek the assistance of a financial advisor before investing. The future of Bitcoin depends on technology, adoption, and halving – and it appears extremely promising!

Disclaimer: These estimates are for educational purposes and are not financial advice. The crypto market is risky.