Solana Price Prediction 2026 To 2030 : Here is analyst’s opinion

New York, 27 November 2025 : Solana (SOL) is a high-speed blockchain platform designed for decentralised applications (dApps) and cryptocurrency transactions. Its hybrid consensus model – Proof of Stake (PoS) and Proof of History (PoH) – enables it to process thousands of transactions per second, distinguishing it from competitors like Ethereum. In 2021, Solana reached a peak price of $295, but the crypto market crash in 2022 caused it to decline. As of 27 November 2025, Solana’s price is around $135-138, resulting in a market capitalisation of over $60 billion.

In this article, we will provide a detailed analysis of Solana price forecasts from 2026 to 2030. These forecasts are based on various market trends, technological advancements, regulatory changes and economic factors. Specifically, by focusing on predictions from American market analysts, we will assess price probabilities, risks and opportunities. As these forecasts are speculative, investors should conduct their own research and seek professional advice.

Key factors affecting Solana prices

The price of solar depends on several factors:

Technological progress: Improvements such as Solana’s Alpenglow consensus upgrades will reduce transaction speed to 150 milliseconds, enhancing the efficiency of dApps.

Adoption and DeFi growth: The total value locked (TVL) of DeFi on Solana has reached $13.22 billion, which will increase institutional investment.

Regulation and ETF Approval: Although the US SEC has postponed its decision on the Solana ETF, there is a 95% probability that approval will be granted by 2026, which would lead to a significant price surge.

Market cycle: Solana could reach $500 due to Bitcoin halving and the altcoin season.

Risk: Network disruption and quantum computing threats (50% probability by 2030) could reduce costs.

Solana Price Forecast by Year (2026 to 2030)

The consolidated estimates from various sources are as follows. These are based on moderate to optimistic scenarios:

Details for 2026: Solana could reach $250-300 in 2026, while optimistic estimates go up to $520. According to CoinCodex experts, this is possible due to DeFi growth and ETF impact. According to CoinDCX, a range of $400-450 is possible.

For 2027-2028: If market stability increases, it will rise to $400-750. According to Ventureburn’s estimates, $398 in 2027 and $500+ in 2028.

For 2029-2030: In the long term, Solana could reach $500-1500. In YouHodler’s optimistic scenario, it could be $1500, while XS gives a base range of $450-680. In a very optimistic estimate, VanEck predicts up to $3211.

Predictions of American Market Analysts (2026 to 2030)

American analysts consider Solana a strong competitor to Ethereum. Here are the key predictions:

VanEck (American asset management firm): Potential increase to $520 by 2025 and up to $3,211 by 2030. This is based on a 43% growth in the smart contract platform, pushing market capitalisation to $250 billion.

Benzinga (American financial news portal): $250-300 for 2026, but a potential 10x increase (i.e., $1,350+) by 2030. This depends on institutional adoption and ETFs.

Forbes Advisor (American media): Projected range for 2026-2030 is $886 to $1,672. This is possible due to the 2024 Bitcoin halving and altcoin season. Additionally, there is a possibility of reaching up to $500 following ETF approval.

Finder (American panel of experts): $331 for 2025, with an average expected to exceed $800 by 2030.

Investing Haven (American crypto analyst): An average of $425 for 2025, potentially reaching over $1,000 by 2030. Firms like Pantera Capital predict up to $1,000.

According to these analysts, Solana can handle the first blockchain with 100 million users, which would result in a 10,600% increase in price.

Conclusions and Recommendations

Solana is likely to show strong growth from 2026 to 2030, with the average price potentially reaching $800, and in an optimistic scenario surpassing $1,500. American analysts consider ETF approval and DeFi growth as key drivers. However, as the market is volatile, risk management is essential.

Investors should pay attention to Solana’s $120 support level, which could enable a recovery up to $140-193. For long-term investment, some experts suggest that Solana could reach $6,300, but this depends on the cycle.

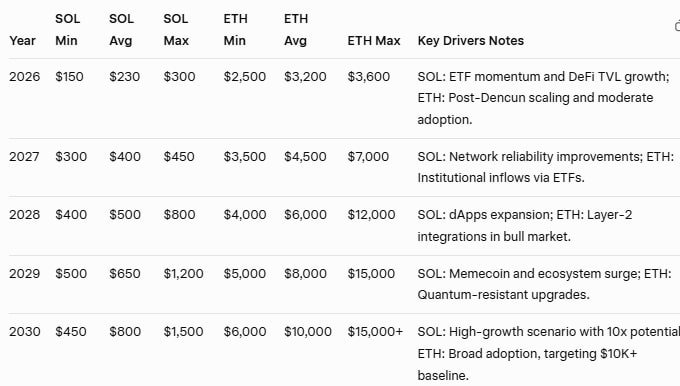

Solana vs Ethereum Price Forecast: Comparative Analysis (2026-2030)

Solana (SOL) and Ethereum (ETH) are two major layer-1 blockchain platforms, with Ethereum leading in smart contracts and DeFi TVL (~$100 billion+), while Solana attracts high-speed dApps and memecoins due to its speed and low fees. As of 27 November 2025, ETH is priced around $3,100, and SOL around $135. Forecasts for 2026-2030 depend on ETF approvals, upgrades (e.g., Ethereum’s Dencun, Solana’s Firedancer), regulatory changes, and macro trends (e.g., Bitcoin halving cycles).

Aggregated estimates have been provided from sources such as Coingecko, Changelly, YouHodler, and AMBCrypto. These are speculative; ETH estimates range from conservative to optimistic ($5,000-$28,000 by 2030), while SOL shows high percentage growth ($250-$1,500+) due to its strong growth trajectory. ROI potential has been estimated based on current prices.

Key Insight:

In 2026: Strong surge for Solana to an average of $350 due to ETF approval, while Ethereum will show stable growth up to $3,500. Solana’s ROI could be 150-300%, and 10-120% for ETH.

2027-2028: Institutional investment will increase in both; Solana will take the lead due to its speed, but Ethereum’s market share (60%) will remain strong.

2029-2030: In an optimistic scenario, Solana could reach $1,500+ (1000%+ ROI), while Ethereum could exceed $20,000 (600%+ ROI) due to smart contract dominance.

Risks: regulatory changes and network disruptions.

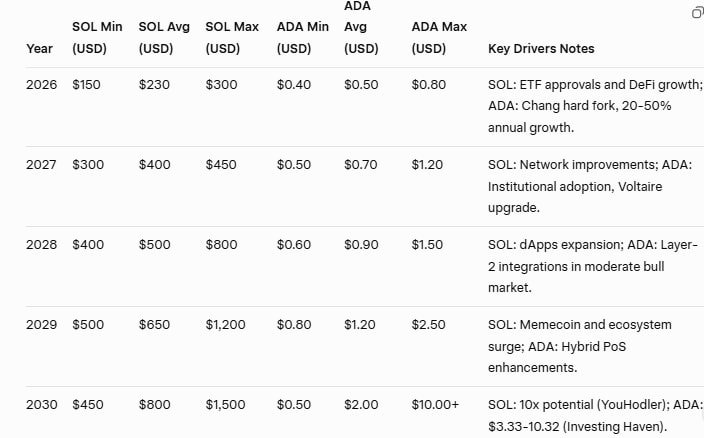

Solana versus Cardano Price Forecast: A Comparative Analysis (2026-2030)

Solana (SOL) and Cardano (ADA) are two major layer-1 blockchain platforms, with Solana leading in DeFi and dApps due to its speed and low fees (TVL – $13 billion+), while Cardano focuses on research-driven development and sustainability, making it considered environmentally friendly and secure. As of 27 November 2025, the price of SOL is around $135, and ADA is approximately $0.35-0.40. Projections for 2026-2030 depend on ETF approvals, upgrades (e.g., Solana’s Firedancer, Cardano’s Chang hard fork), regulatory changes, and macro trends (e.g., Bitcoin halving).

Estimates have been compiled from sources such as Khali, Changelly, Benzinga, Youhodler, Coincodex, and Investing Haven. These are speculative; estimates for SOL are more optimistic ($250-$1,500 by 2030), whereas ADA estimates are conservative to moderate ($0.50-$10), as Cardano’s growth is slow but steady. ROI potential is estimated based on current prices.

Key insight:

2026: Strong jump to an average of $230 for Solana due to the ETF effect, while Cardano will show steady growth up to $0.50. SOL’s ROI could be 70-120%, and for ADA 25-100%.

2027-2028: Institutional investment will increase in both; Solana will take the lead due to its speed (market share -5%), but Cardano’s stability (-3% share) will be beneficial in the long term.

2029-2030: In an optimistic scenario, Solana could reach $1,500+ (1000%+ ROI), while Cardano could reach $10+ due to research-driven adoption (2500%+ ROI).

Risks: regulatory hurdles, competition (e.g., Ethereum) and network congestion.

Disclaimer: These estimates are for educational purposes and are not financial advice. The crypto market is risky.