ADI Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 15 December 2025: Analog Devices Inc. (NASDAQ: ADI) is a leading semiconductor company, focusing on analogue, mixed-signal, and digital signal processing products. It has a strong presence in sectors like automotive, industrial, communications, and consumer electronics. By the end of 2025, ADI stock price (Penny Stocks to Buy now) reached around $279, attracting investors’ attention because of its future growth potential. In this article, we will discuss ADI’s share price forecast from 2026 to 2030, analysts’ predictions, the company’s pros and cons, plans, total returns for investors, and the impact of US government policies.

Pros and cons of Analog Devices Inc.

ADI is known for its strong financial position and diversification, but there are some risks due to the cyclical nature of the semiconductor industry.

Pros

- Diversification: Double-digit revenue growth from industrial, automotive, communications and consumer sectors, which brings stability.

- Strong financial health: The current assets are worth twice the liabilities, with a free cash flow margin of 39%, giving flexibility for R&D and acquisitions.

- AI and the growing market: The potential to increase market share by reducing dependence on Nvidia through AI-powered products like CodeFusion Studio.

- Consistent performance: Expect growth after reaching the long-term price target.

Cons:

- Geopolitical risk: Dependence on sales in China (a significant revenue source) and tensions due to export controls.

- EV market slowdown: Demand for semiconductors might drop as EV tax benefits end.

- Competition and evaluation: Challenges in AI chips due to rivals like Nvidia and AMD; 19% overvaluation.

- Jim Cramer’s critique: Some analysts say ADI is not worth buying, with less growth potential compared to AI shares.

Highlights of the company’s plans

ADI recorded strong performance in 2025, with double-digit revenue growth expected in the third quarter. The following points are important in the company’s strategic plans:

- Expansion in automotive and industrial: strengthening leadership through complete system solutions and growth in digitalized factories, mobility, and digital healthcare.

- Growth in connectivity and digital: Exploring opportunities in AI, automation and robotics.

- Strong global supply chain: Increase sales and product diversity at facilities in Malaysia through a partnership with ASE.

- Environmental and economic goals: Include future targets in the investor presentation, expecting a 35 billion dollar increase in the analog market for 2025-2026.

These schemes will give ADI long-term growth, especially in 2026 when ‘broad-based growth’ is expected.

Total return given to investors

ADI has given investors excellent long-term returns. Over 10 years (2015-2025), the total shareholder return (TSR) has been over 375%, with a compound annual growth rate (CAGR) of 18.71%. In ten years, more than 19 billion dollars in cash has been returned to shareholders, with a dividend CAGR of 9.5% to 10%.

According to the latest statistics:

- TSR in 12 months: 33.36%

- 2025 YTD: 34.11%

- Last 2 years: more than 30%

Even though there was a 16.1% drop in 2022, the total return over 10 years was 370.17%. It’s better than the S&P 500.

American government policy and its impact on ADI

American government policies have a big impact on the semiconductor industry, especially on companies like ADI.

Positive impact of the CHIPS Act:

The CHIPS Act, passed in 2022, provided production grants, investment tax credits, and funding for R&D. This led to $500 billion of private sector investment, and America’s semiconductor production capacity is set to triple between 2022 and 2032. ADI will benefit from these grants and tax credits to boost domestic production, strengthening the supply chain and reducing costs.

Negative impact of export controls:

Since 2018, China has imposed restrictions on the export of advanced semiconductors, which have affected ADI’s sales. The 2022-2023 rules have boosted America’s dominance in AI hardware, but revenue in China could decline. Also, China has started probing US analogue chip companies for financial and operational information, increasing supply risk.

Overall, the CHIPS Act will bring long-term benefits, but export controls might reduce sales in the short term.

ADI’s main AI policies and focus areas

- Intelligent Edge AI: ADI’s main focus is on doing AI inference on edge devices, which boosts energy efficiency and allows real-time decision making.

- AI-driven industrial automation: solutions for predictive maintenance, robotics and smart factories.

- Power solutions for AI accelerators: high-efficiency power management for AI chips (like GPUs) in data centres.

- Announcement for 2025: Launch of a corporate venture capital fund called ADVentures, which will invest in AI-related startups (in robotics, health, and energy sectors).

Major AI-related products and platforms

ADI’s AI products are mainly based on software tools, microcontrollers and power solutions

CodeFusion Studio 2.0 (launched in November 2025):

This is an open-source embedded development platform based on Visual Studio Code.

- Features: End-to-end AI workflow support, bring-your-own-model (import your own AI models), multi-core applications, runtime profiling and layer-by-layer analysis.

- Benefits: It’s easy to deploy AI models on all ADI processors and microcontrollers, from edge devices to high-performance DSPs.

This helps developers make AI-enabled embedded systems faster.

MAX78000 microcontroller:

An ultra-low power AI microcontroller that runs convolutional neural networks (CNN) on the edge.

- Applications: machine vision, health signal analysis, predictive maintenance and multi-sensor analysis.

- Feature: On battery-powered devices, the energy penalty for AI inferencing is almost zero.

Power solutions for AI accelerators:

- High-efficiency power conversion and POL (point-of-load) products with SilentMOS technology

- Application: For AI GPUs and accelerators in data centers (48V and 12V systems).

- Advantages: High power density, low heat and scalable output.

Other AI-enabled solutions:

- AI-based condition monitoring and predictive maintenance (for factory automation).

- Sensor fusion and edge processing tools that create datasets for training AI models

- Flex Logix Acquisition (2025): Embedded FPGA and AI IP technology making adaptable AI possible in edge devices.

Partnership of ADI in AI and the future

- Partnership with Flagship Pioneering (2024): AI/ML applications for digital biology (bioelectronics, regenerative agriculture and preemptive health).

- Robotics and Industrial AI: Solutions for humanoid robotics and autonomous manufacturing.

- Performance in 2025: Double-digit growth in the industrial segment in Q2 and Q3 2025, mainly due to AI-driven automation.

ADI Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

Analysts in the US stock market are positive about ADI’s shares, but are being a bit cautious due to short-term volatility. According to the consensus of 27 analysts, ADI has a ‘buy’ rating with an average price target of $266.75, ranging from a high of $310 to a low of $220. In the long term, the company’s growth in AI and the automotive sector is expected to drive its share price, but the EV market slowdown and geopolitical tensions will be challenges.

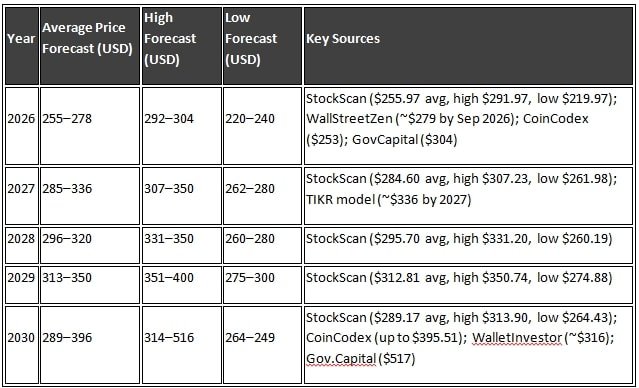

According to various sources, the estimated prices for 2026 to 2030 are as follows (compared to the current 279 dollars):

According to these estimates, the price will stay between 240 and 302 dollars in 2026, and could rise to 275 to 385 dollars by 2030. Some analysts suggest a drop in 2026 due to EV car incentives ending, but with the growth of AI, a positive recovery is expected by 2030. In the long term, a 37.92% increase by 2030 is expected, which is attractive for investors.

Conclusion

ADI stock price is looking positive for 2026-2030, and analysts predict it could rise to 300-385 dollars. The company’s strong profits, strategic plans, and historical returns attract investors, but remember the risks. Government policies bring both opportunities and challenges. Get professional advice before investing.