ATCH Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 05 December 2025, ATCH Stock Price Forecast News │ Atlasclear Holdings Inc. (NYSEAMERICAN: ATCH) is a technology-enabled financial services company that develops an efficient platform for trading, clearing, settlement and banking. The company focuses on driving innovation in the fintech sector and helps clients reduce transaction costs through a prime brokerage model. Established in 2021, the Atlasclear Holdings Inc. company (Best Penny Stocks to Buy) operates through wholly-owned subsidiaries such as Wilson-Davis & Company. Atlasclear Holdings Inc. aims to bring greater efficiency to the financial markets through technology and to provide new services to leading players in the wealth management sector. The company is currently traded on the NYSE American and focuses on fintech innovation.

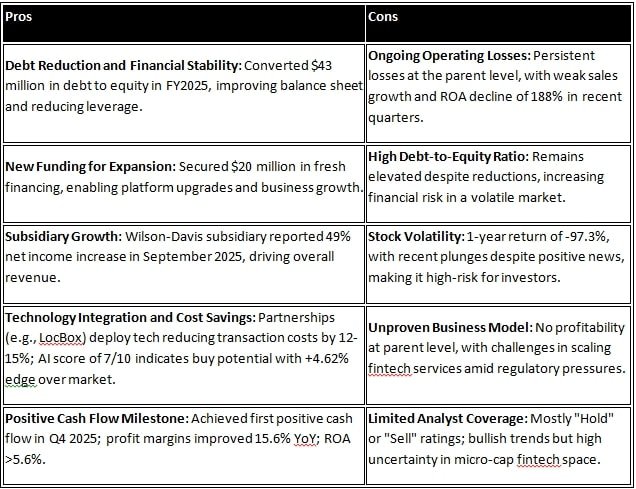

Advantages and disadvantages of Atlasclear Holdings Inc.

As Atlasclear Holdings Inc. is an emerging fintech company, its advantages and disadvantages are both clear. The following table summarizes them:

Overall, the benefits are based on the capacity for expansion, while the drawbacks depend on the weaknesses in financial stability.

Future plans of Atlasclear Holdings Inc.

Atlasclear Holdings’ plans for FY2026 focus on expansion and innovation. The company’s CEO states, “We are developing modern clearing and banking platforms.” Main plans:

- Expansion of business lines: The stock loan business grew to 12% revenue by June 2025, reaching over 15% in July-August. Increasing wealth management services through new acquisitions.

- Technology Deployment: Platform upgrade using $20 million financing with fintech partners like LocBox. Triple-digit revenue growth in October 2025.

- Debt restructuring and capital raising: $21.25 million debt repaid in full, and partnership with investors such as Higher Hanire Inc.

- New business: Investment management services for wealth advisors, and presentations at the Emerging Growth Conference.

These schemes are likely to increase revenue by 295% in 2026, thereby providing the company with a strong position on the NYSE American.

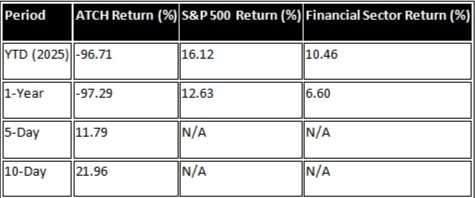

Total return provided by Atlasclear Holdings Inc. to investors

Atlasclear Holdings has provided investors with mixed returns, influenced by the company’s volatility. Data up to 2025:

- YTD return: 96.38% (as of 4 December 2025), benefiting short-term investors.

- 1-year return: -97.3%, resulting in losses for long-term holders.

- 5-day/10-day returns: +2.48% and +0.007% respectively, due to recent heat (discussed on Reddit DD).

- Total Shareholder Return (TSR): Lower than the S&P 500 (-91.4% versus the market), but 5.7% below the capital markets industry.

Although the company has initiated discussions on dividends, no dividend has been announced yet. Overall, the $43 million debt cleanup is likely to improve future TSR.

Impact of US government policy on Atlasclear Holdings Inc.’s product/service

The policies of the US government are important for fintech companies like Atlasclear as they impact financial stability and regulations. According to SEC filings, the company’s outcomes depend on the US economic and political situation, such as inflation, interest rates, and fintech regulations.

- Positive outcome: The Dodd-Frank Act and CFTC regulations increased transparency for clearing platforms, benefiting Atlasclear’s technology-enabled services. The Federal Reserve’s interest rate cut in 2025 led to higher trading volumes, positively impacting the company’s stock lending business.

- Negative outcomes: High inflation (over 3% in 2025) and political uncertainty (e.g., post-election policies) have increased operating expenses. Due to stringent SEC regulations (such as S-1 filing), the company took time to resell $51.9 million in shares, leading to stock volatility.

- Future Impact: Expected fintech regulations in 2026 (such as digital asset clearing) will provide opportunities for the Atlasclear platform but will increase compliance costs.

Overall, government policies provide opportunities for company growth, but uncertainties increase the risks.

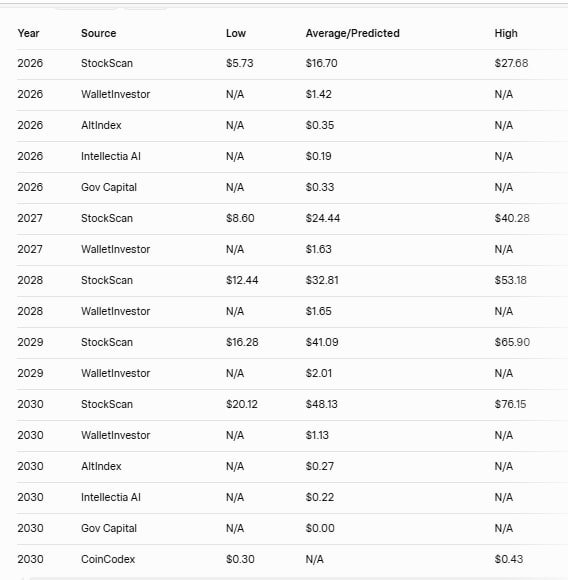

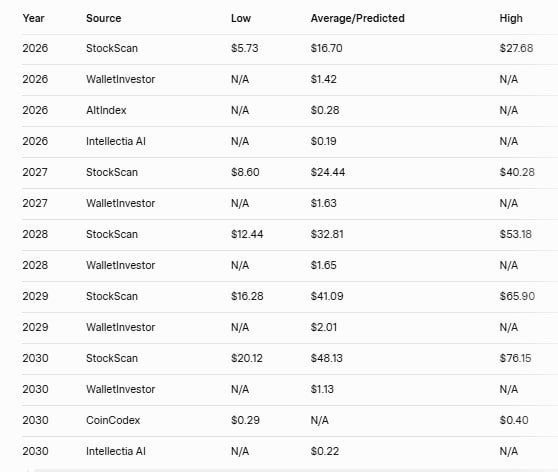

ATCH Stock Price Forecast 2026 to 2030

The price of ATCH stock has remained extremely volatile. Although the YTD (year-to-date) return in 2025 was a positive 96.38%, it has fallen by 97.3% over the past year, creating uncertainty among investors. The price forecasts for 2026 to 2030 show significant variation, depending on the company’s growth potential and associated risks.

ATCH Stock Price Forecast 2026

According to various sources, the stock price could reach between $0.19 and $0.47. According to AltIndex’s AI-based forecast, a price of $0.28 is expected in 2026, whereas Intellectia AI predicts $0.19.

ATCH Stock Price Forecast 2030

From a long-term perspective, some optimistic estimates reach an average of $48.13 (high $76.15, low $20.12), but most sources remain cautious. CoinCodex suggests $0.2872 to $0.3977, WalletInvestor $1.128, and Gov Capital as low as $0.002673. These forecasts depend on the company’s debt reduction efforts and the growth of the fintech market.

Overall, by 2030, the price of ATCH is likely to range from $0.22 to $1.128, but due to high risk, cautious investment is necessary.

ATCH Stock Price prediction 2026-2030 of American stock market analysts

American stock market analysts (such as Yahoo Finance, CNN, and AI-based platforms) consider ATCH Stock a high-risk, high-return stock. According to Danelfin’s AI score (7/10), ATCH has a 4.62% chance of outperforming the market. In Tickeron’s recent analysis (November 2025), the Aroon indicator showed a downward trend, indicating a possibility of short-term decline.

In long-term forecasts:

- Positive outlook: Sources like StockScan.io expect a 63,362% increase by 2030 ($111 to $143.81), as the company’s fintech platform is expected to grow.

- Cautious outlook: Simply Wall St and Perplexity AI recently reported that operational losses and weakness in sales will make stability difficult during 2026-30. WalletInvestor expects growth to $1.128 over five years but expresses concern over an 188% decline in ROA.

Analysts have unanimously given ATCH a “Buy” rating, but only for experienced investors, as market volatility (such as the stock plunge in Q4 2025) increases risk.

Conclusion

Atlasclear Holdings Inc. is an exciting yet risky company in the fintech sector. Although stock forecasts for 2026-30 are positive, analysts remain cautious. Profits are based on expansion, while losses are due to financial weaknesses. Future plans are promising, offering investors mixed returns. The impact of US policies is mixed. Seek independent advice before investing.

Disclaimer | This is not financial advice. Stock prices are volatile, and the market is subject to risks. Seek the assistance of a professional advisor before investing.