ATYR Stock Price Forecast 2026 To 2030: Penny Stocks Under $1

New York, 02 December 2025 │ aTyr Pharma Inc. (NASDAQ: ATYR) is a biotechnology company developing new therapies for rare lung diseases. The company’s lead product candidate, ‘efzofitimod’, is being developed for conditions such as systemic sclerosis-associated interstitial lung disease (SSc-ILD) and pulmonary sarcoidosis. In September 2025, the company’s shares fell by 83% following the failure of its Phase 3 clinical trial, creating uncertainty among investors.

Nevertheless, the company has a strong cash position and potential FDA support, which offers hope for long-term growth. This article reviews share price forecasts for 2026 to 2030, target prices from US stock market analysts, the company’s positive and negative aspects, debt status and plans, as well as US government (FDA) policies.

American stock market analysts’ target price forecasts

After the phase 3 failure, there were changes in analysts’ ratings. According to MarketBeat, the 12-month average target of 8 analysts is $23.25, with a maximum of $35 and a minimum of $10 (as of February 2025). However, in updates after September 2025:

- RBC Capital: Sector Perform, target $10.31 (October 2025).

- Jefferies: Buy rating, target $17 (previously raised before trial).

- Cantor Fitzgerald: Downgraded to Hold due to failure.

- Leerink: Outperformance rating maintained, based on other endpoints.

- Tip rank: Hold, $6.00 target (most recent).

According to stock analysis, there is a ‘buy’ consensus from 4 analysts with an average target of $8.75, indicating a 1080% increase from the current price. According to TradingView, the average is $6.56 (max 22, min 1). Overall, after the failure, targets remain stable between $6 and $10, but growth may occur based on the success of the SSc-ILD trial.

The positive and negative aspects of aTyr Pharma Inc.

Positive aspects (Strength)

- New Platform and Pipeline: A unique platform based on tRNA synthetase biology is enabling the development of new therapies for rare lung diseases. Positive results were obtained in the Phase 1b/2a trial for Efofitimod, generating excitement among patients and doctors.

- Experienced leadership and focus: A company focused on rare diseases, with a strong leadership team.

- FDA support: Orphan drug and fast track designation, which accelerates development.

- Valuation: The price-to-book ratio decreased by 1.4x, making it considered undervalued.

Negative aspects (weakness)

- Financial Challenges: Continuous losses and negative cash flow, net loss of $25.7 million in Q3 2025. Pre-tax profit margin -1817.7%, limited cash sources.

- Clinical failure: Phase 3 EFZO-FIT trial failed, primary endpoint missed. Risk due to reliance on a single key asset.

- High expenditure: R&D expenses of $22.1 million (Q3 2025), posing a risk of dilution.

- Legal issue: Class action lawsuit due to misleading statements (deadline by December 2025).

The company’s debt situation and strategy

aTyr Pharma’s debt position is relatively strong. As of 30 September 2025, total debt is zero, with only a financing lease liability of $1.028 million (long-term $0.398 million). Total assets stand at $106.652 million, liabilities at $15.678 million, and cash and equivalents at $6.150 million (total cash and investments $92.9 million). The debt-to-equity ratio is 0%, indicating financial stability.

Plan:

The company has a minimum cash runway of one year. Future funding is planned to be obtained through equity offerings, grants, partnerships, and licensing. A meeting with the FDA is scheduled for Q1 2026, during which the Phase 3 results will be reviewed to determine the next steps for pulmonary sarcoidosis. The Phase 2 EFZO-CONNECT trial for SSc-ILD will be completed in the first half of 2026. Debt financing will be considered as a commercialisation approach.

The policy of the American Government (FDA) on aTyr Pharma Inc. products

The FDA has provided supportive policies for Ezofitimod for rare diseases.

- Orphan drug designation: For systemic sclerosis (SSc) and sarcoidosis (April 2022).

- Fast track designation: For SSc-ILD (September 2022), which accelerates development.

- Expanded access policy: Access for patients outside clinical trials, allowing for testing of safety and efficacy.

After the failure of Phase 3, the company will discuss with the FDA, which may provide a path based on other endpoints. Overall, the FDA’s policy for rare diseases is advantageous for the company, but approval may take years.

ATYR Stock Price Forecast 2026 To 2030

Long-term estimates of aTyr Pharma’s stock price are mixed according to various sources. Although the share price fell to around $1.02 following the Phase 3 failure, there is potential for growth based on other trials in the company’s pipeline and discussions with the FDA.

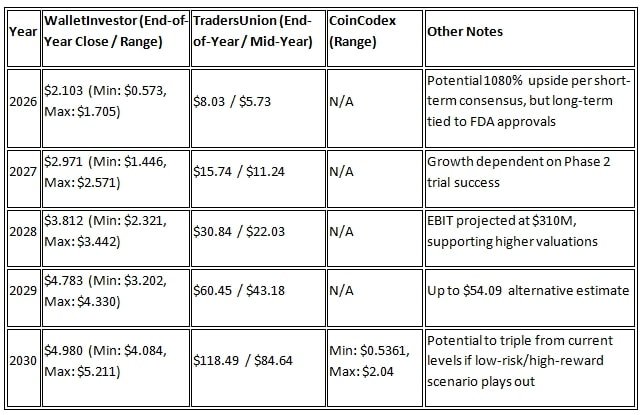

ATYR Stock Price Forecast 2026

According to CoinCodex, the share price in 2026 is expected to range between $0.53 and $2.04, indicating a modest increase from the current price. StockScan predicts a short-term negative trend with an average target of $0.00, reflecting the company’s financial challenges. Wallet Investor’s forecast is more optimistic, suggesting the possibility of reaching up to $1.673 by 2026.

ATYR Stock Price Forecast 2027 – 2028

According to Traders Union estimates, it could rise to $54.09 by 2029, depending on the company’s successful phase 2 trials and partnerships. However, according to Simply Wall Street forecasts, a break-even (profit-loss zero) is expected in 2026, resulting in the share price remaining stable between $4-$6.

ATYR Stock Price Forecast 2029 – 2030

According to Wallet Investor, it is likely to reach up to $4.980 by 2030. Yahoo Finance’s analysis recognises ATYR as a ‘low risk, high reward’ stock, with the potential for a threefold increase by 2030 if FZOFITIMOD receives FDA approval. CoinCodex’s range for 2030 is $0.5361 to $2.04, indicating caution. Overall, forecasts fall within a wide range of $0.5 to $50, depending on clinical success and market volatility.

Conclusion

aTyr Pharma is a high-risk, high-reward biotech company. From 2026 to 2030, the share price could range from 2 to 50 dollars, depending on Phase 2 success and FDA approval. Although analysts’ targets are 6-10 dollars, its debt-free status and 92.9 million dollars in cash provide support for investors. Despite a positive pipeline, caution is advised due to potential failures and losses. Consult an expert before investing.

Disclaimer | This is not financial advice. Share prices are volatile and the market is subject to risks. Seek the assistance of a professional advisor before investing.