AVAV Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 15 January 2026: Aerovironment, Inc. (NASDAQ: AVAV) is a leading American company specializing in unmanned aerial systems (UAS), drones, counter-UAS technology, space-based platforms and defense technology. The company primarily provides products and services for the US government and international partner countries. As of January 2026, the company’s market cap is around $18.51 billion and the stock price is $381.80. The company is growing rapidly in the defence sector, especially due to rising demand for drones and robotic systems because of Ukraine and other conflicts. In this article, we will take a detailed look at AVAV stock’s price forecast from 2026 to 2030, predictions by American stock market analysts, the company’s pros and cons, its plans, the total return for investors, and the impact of US government policies on the company’s products.

AVAV Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

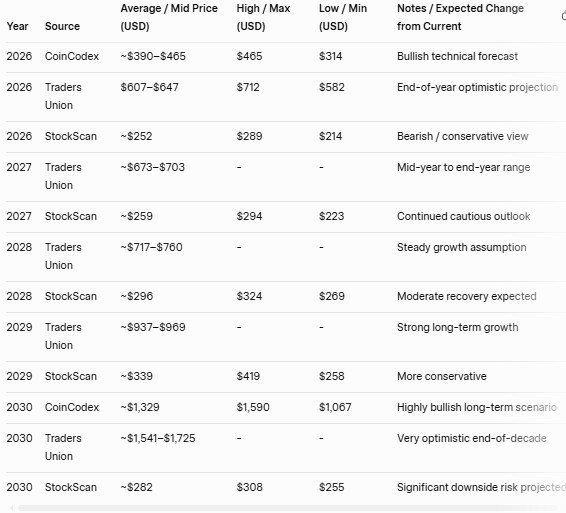

There are different predictions from various sources in the long-term forecast of AVAV stock. These forecasts are based on the company’s revenue growth, acquisitions (like BlueHalo), and the defence budget. The table below shows the forecasts from major sources:

These forecasts are optimistic, especially given the company’s $2 billion FY26 revenue target and the expected growth of $3.5 billion by 2030. However, some sources (like StockScan) are more cautious, showing an average of $282 by 2030. These forecasts depend on market volatility, competition and global conflicts.

The pros and cons of AeroEnvironment, Inc.

Pros

- Innovation and product variety: The company specialises in small to medium UAS, featuring AI and modular platforms. In 2025, it invested $100.7 million in R&D.

- Revenue growth: Revenue doubled due to acquisitions (Bluehalo), and there is a backlog of $1.1 billion from defense contracts.

- Market position: Strong in defense tech, global presence and 75% revenue with the US government.

Profitability: EPS is expected to grow 62.07% per year.

Cons

- Government dependence: 75% of revenue on the US government, with the risk of budget cuts.

- High valuation: stock is expensive, P/E -126.57 and 41x 2030 earnings.

- Competition: Companies like Kratos and Anduril have increased the competition.

- Financial challenges: Profits dropped due to the acquisition, and there was share dilution.

AeroVironment, Inc.’s plan

The company’s plan focuses on AI, autonomous systems and multi-domain operations. Main points:

- AV_Halo platform expansion: with CORTEX and MENTOR integration, including autonomous mission agents, simulation and airspace deconfliction

- Acquisitions and capacity boost: BlueHalo acquisition expands in counter-UAS and space. $150 million investment in production capacity (Switchblade, JUMP 20).

- New products: Mission Specialist Wraith UUV, Golden Dome Initiative and international sales

- Revenue target: $2 billion by FY26 and $3.5 billion by 2030.

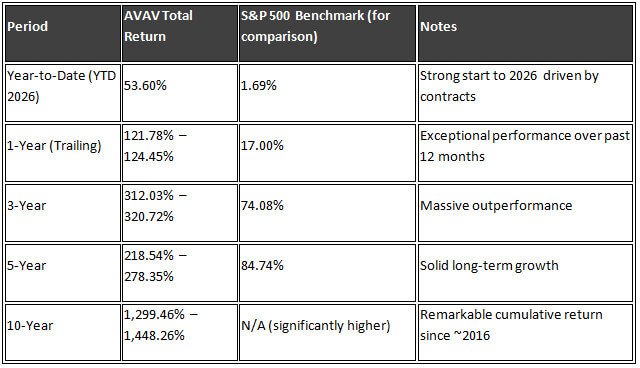

Total return given to investors by AeroVironment, Inc.

AVAV stock price predictions by American stock market analysts from 2026 to 2030

American analysts have a unanimous ‘strong buy’ opinion, with 15 to 23 analysts participating. The average target for a one-year period is $367.47 to $391.30, with a high of $450 and a low of $275. Long-term forecasts are more varied:

- 2026: $375.80 to $462 (Intellectia AI, CoinCodex)

- 2030: $266 to $1,668 (StockScan, Traders Union)

Analysts are optimistic about the company’s acquisition and defence demand, but they are concerned about the high valuation (41x 2030 earnings).

The company has historically given strong returns (up to January 2026):

This return is due to a 29.4% annual revenue growth, which is more than the S&P 500.

Impact of American government policies on AeroEnvironment, Inc.’s product

The American government’s policies have a positive impact on the company

- Contracts and IDIQ: $874 million FMS IDIQ for UAS and C-UAS, $4.8 million for the Coast Guard.

- NDAA compliance: Ban on Chinese drones benefits the company, giving priority to American products.

- Pentagon policy: speeding up drone purchases, including ‘Buy American’ and removing restrictions.

- FCC and import ban: competition reduced due to the ban on foreign drones, but according to some sources, the restrictions have been lifted.

This policy is important for 75% of the company’s revenue, where demand has increased due to global conflicts.

Conclusion

Environment, Inc. is strong in defense tech and has long-term growth potential. The outlook is optimistic, but high valuation and competition risks exist. Investors should consider market trends and government policies.