BITF Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 15 January 2026: Bitfarms Limited (NASDAQ: BITF) is a North American energy and digital infrastructure company that mainly operates in Bitcoin mining. The company went public in 2021 and is listed on NASDAQ. In this article, we will take a detailed look at BITF stock price estimates from 2026 to 2030, forecasts by American stock market analysts, the company’s pros and cons, company plans, the overall returns to investors, and the impact of US government policies on the company’s products and services. This information has been gathered from various sources and is up to date as of 15 January 2026.

BITF Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

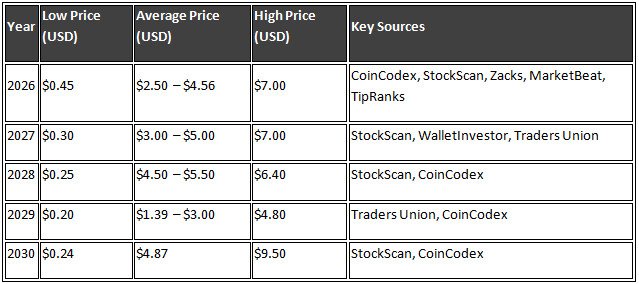

The estimated stock prices of Bitfarms depend on various factors, such as the price of Bitcoin, the company’s expansion plans, energy costs, and market volatility. The table below shows the average estimate from 2026 to 2030 (in USD):

These estimates are taken from sources like CoinCodex, StockScan and Traders Union. The stock price is likely to stay between $1 and $4 in 2026, but if Bitcoin reaches $200,000, it could hit $7 to $9. By 2030, an average increase to $4.87 is expected, with a chance of going up to $9.50, but this depends on the growth of the Bitcoin market and the company’s success in AI/HPC.

American stock market analysts’ BITF stock price predictions from 2026 to 2030

According to American analysts, BITF stock has a “moderate buy” rating. Based on 8 to 10 analysts on platforms like Zacks, TipRanks and MarketBeat, the average price target is $4.25 to $4.56 (minimum $2, maximum $7). For long-term forecasts, Fintel predicts $3.88 by 2026 (minimum $1.46, maximum $6.47). Sources like Seeking Alpha have a target of $7. By 2030, StockScan estimates an average of $4.87, with potential growth due to the shift in AI/HPC. Analysts are bullish, but there are risks due to Bitcoin’s volatility.

Pros and cons of Bitfarms Limited

Pros

- Efficiency and low cost: The company is the most efficient Bitcoin miner with low energy costs.

- Expansion and diversification: Moving into AI/HPC, which has long-term revenue potential.

- Strong liquidity: $118 million in cash and zero debt.

- Undervalued: According to some analysts, the stock is undervalued and could give multibagger returns.

North American focus: 80% US-based energy pipeline

Cons

- Risk and volatility: Depending on Bitcoin’s price, which has big ups and downs.

- Negative return: ROE -9.9% and ROIC -9.5%, showing a loss.

- Execution risk: The risk, dilution and competition in successfully transitioning to AI/HPC.

- Overvalued metrics: PB over 2.24 and PS over 3.3, indicating high valuation.

- Regulations and environmental concerns: regulation risks due to energy use.

Bitfarms Limited’s plan

Bitfarms is a digital infrastructure company running 13 data centers with 400 MW of power capacity (US, Canada, Argentina and Paraguay). The main plan is to shift from Bitcoin mining to AI/HPC infrastructure. By 2026-2027, the aim is to reduce Bitcoin mining and grow US-focused energy and digital infrastructure. They have a 1.3 GW energy pipeline, 80% US-based. Conversion of the Washington site to AI/HPC (190 KW per rack). Revenue diversification through deals like the Stronghold acquisition and Yguazu data centre sale. Capex down 20% in 2025, no new miners, focus on AI. Long-term goal: stable cash flow, independent from BTC volatility.

Total return given to investors by Bitfarms Limited

The total return given to investors by the company (Total Shareholder Return) is volatile. From 01-06-2021 to 15-01-2026: starting price $3.96, latest $2.96, total return -25.38%. YTD (2026) 23.53%, 1 year 88.46%, 3 years 174.77%, 5 years 12.24%. Revenue growth average 35.42%, but losses made ROE negative. In 2024, revenue $192.88 million, but loss -$54.06 million. Long-term investors saw positive returns, but volatility carries risk.

Impact of US government policies on Bitfarms Limited’s products and services

There is no federal framework for crypto mining in the US, but there are state-level rules. Due to energy use and environmental concerns, New York has a two-year ban on fossil fuel-based mining. States like Arkansas have rules for noise and permits. The SEC regulates crypto securities, with rules for AML/KYC. Concerns about Chinese-owned mines posing US grid and security risks. Trump’s executive order could be positive for the Bitcoin reserve. Impact: higher energy costs for companies, expansion limits, but risks lower due to AI/HPC transition. Environmental rules push towards cleaner technology.

This article is informative and not investment advice. Get professional advice before investing.