BYND stock Price Forecast 2026 To 2030 : Here is the analyst’s opinion

New York, 27 November 2025: Beyond Meat Inc. (BYND) is a leading company producing plant-based meat alternative products, established in 2009. The company sells products such as Beyond Burger, Beyond Sausage, and Beyond Beef, which are recognised as environmentally friendly and healthy options. In November 2025, the company’s share price fell to approximately $0.98, raising concerns among investors.

However, with the plant-based food market projected to grow to $162 billion by 2030, there are future opportunities for the company. In this article, we will discuss share price forecasts from 2026 to 2030, predictions from American stock analysts, as well as a detailed discussion of the company’s positive and negative aspects. This analysis is based on web searches and analyst reports.

Positive aspects of the company (Strengths)

Beyond Meat is a leading company in the plant-based market, and its numerous strengths position it for future growth. Here are the main positive aspects:

Strong brand recognition and innovative products: The company’s products look and taste like meat, making them appealing to flexitarian and vegetarian consumers. Products like Beyond Burger and Sausage have been successful in the market.

Environmentally friendly and ethical operations: The company’s products result in lower greenhouse gas emissions, water use, and land requirements compared to animal farming. This is a significant attraction for environmentally conscious consumers.

Strategic Partnership: Partnerships with major food chains such as McDonald’s, Subway, and Taco Bell enhance distribution and visibility. This helps the company to expand its market.

Quality and Nutritional Values: Products that are GMO-free, hormone-free, and antibiotic-free, with high protein and low saturated fat content. This is beneficial for health-conscious consumers.

International expansion: The ability to customize products according to local tastes in markets such as Asia and Latin America.

Commitment to cost reduction: In 2025, the company ensured short-term liquidity by securing debt financing and has initiated efforts to improve margins.

Due to these positive factors, the growth of the plant-based market (7.7% of the global protein market by 2030) could benefit the company.

Negative aspects of the company (Weaknesses)

On the other hand, Beyond Meat faces numerous challenges, which have caused its shares to decline. A drop in sales and financial instability has been observed in 2025. Key negative points:

High cost: As products are more expensive than traditional meat, price-sensitive customers stay away. This is the main reason for the decline in sales in the American retail channel.

Decline in sales and revenue: Revenue fell by 14% in the third quarter of 2025, while weak demand and reduced distribution points led to a decline in volume. Guidance for FY25 was also withdrawn.

Financial Weakness: Negative EPS (expected -4.61 for 2026) and the percentage of bills delayed by 31-60 days increased to 19.2%. Additionally, financial reports indicated a ‘material weakness’, resulting in the delayed release of the earnings report.

Supply chain risk: Dependence on raw materials such as P protein can lead to disruptions due to weather, pests, or regulations.

Limited product variety and international presence: Fewer products compared to competitors and challenges in cultural adaptation.

Insecurity about health trends: consumer concerns about additives, sodium, and processing are increasing.

Due to these negative factors, the company is facing a financial crisis, and despite a 440% increase in shares in 2025, there is a possibility of underperformance.

Predictions of American Stock Analysts (2026 to 2030)

According to American analysts (such as Fintel, Stockscan, and Wallet Investor), the future of BYND is uncertain. The majority of ratings are ‘sell’ or ‘hold’, and the average price target is low. Here are the main predictions:

Analyst Ratings: 1 Strong Buy, 5 Hold, 5 Sell, 2 Strong Sell (as of November 2025).

Average price target: $2.64 for 1 year (a 206% increase from the current price, yet still low). Low target $0.81 dollars, high $6.90.

Revenue and EPS Estimates: For 2026, revenue is expected to be $810 million (80% growth anticipated), but EPS will be -4.61. For 2027, revenue is $939 million, EPS -0.39; for 2028, $1,024 million, EPS -0.66.

Long-term forecasts are varied, including bullish (StockScan) and bearish (AI Pickup, Wallet Investor). According to analysts, the company needs to reduce expenses and expand into new markets, otherwise, there will be a decline.

BYND Stock Price Forecast: 2026 to 2030

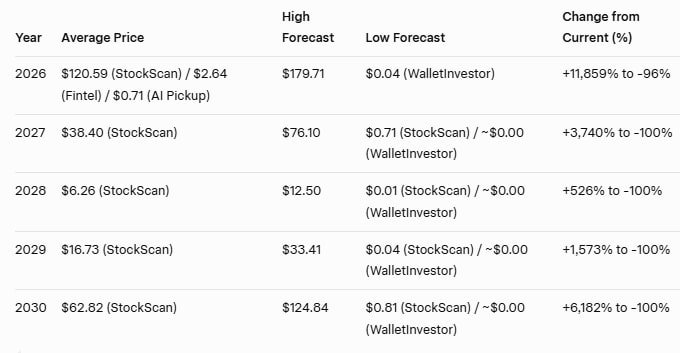

Estimates are based on various sources, including analysis of financial reports and earnings history. The table below shows average, high and low estimates (in dollars):

2026: Most analysts are bearish, averaging $2.64 (Fintel). However, sources like StockScan are bullish up to $120.

2027-2028: Although revenue growth is expected, the price will remain volatile due to negative EPS. Sources like Wallet Investor predict a decline to $0.04.

2029-2030: Return possible due to market expansion, but risks exist due to competition and consumer preferences. Bullish outlook up to $62, bearish nearly zero.

Opportunities and Risk

Opportunity: International expansion (Asia), new products (snacks, dairy alternatives), investment in R&D and digital marketing. Participating in government health campaigns could be beneficial.

Risk: Competitors such as Impossible Foods, Tyson and Nestlé, reduced consumer spending due to economic downturn, supply disruptions and changes in regulations.

Conclusion

Beyond Meat’s BYND shares are expected to experience significant fluctuations between 2026 and 2030, with bullish forecasts reaching up to $120 and bearish projections near zero. Most analysts are giving sell ratings, and the company needs to increase sales and reduce costs. Investors should make decisions considering the risks; this is for general information and not professional advice. Growth in the plant-based market could provide the company with a revival, but caution is warranted due to its current weakness.