GPUS Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 05 December 2025, GPUS Stock Price Forecast News │ Hyperscale Data Inc. is a leading data center company specializing in artificial intelligence (AI) and digital assets. Traded on the NYSE American under the ticker GPUS (NYSEAMERICAN: GPUS), the company combines high-performance AI computing with Bitcoin-based financial stability. Its main products and services focus on the development of data centers, including scalable and secure solutions for AI/ML computing.

By 2025, the Hyperscale Data Inc. company has taken steps towards spinning off from Ault Capital Group (ACG) and is transforming into a pure AI and digital assets company. This article will provide a detailed discussion on GPUS stock price forecasts from 2026 to 2030 (Best Penny Stocks to Buy), predictions from American stock market analysts, the company’s advantages and disadvantages, future plans, overall returns provided to investors, and the impact of US government policies.

Advantages and disadvantages of Hyperscale Data Inc.

A key advantage of Hyperscale Data Inc.’s business model is the integration of AI and Bitcoin, but there are also environmental and economic challenges.

Advantages (Pros):

- Rising demand for AI/ML computing: The company’s data centers are scalable for AI, enabling structural demand growth. Economies of scale reduce costs, and there are high switching costs for specialized computing.

- Reduced debt and cash amount: $30 million of debt has been reduced, and $24 million in cash is available, which is useful for the Michigan Data Center expansion.

- Bitcoin-based stability: a $100 million Bitcoin treasury strategy provides financial strength, supporting AI infrastructure.

- High-paying jobs and tax revenue: Data centers boost the local economy.

Disadvantages (Cons):

- High energy and water consumption: Hyperscale data centers could use 16 to 33 billion gallons of water by 2028, raising environmental concerns.

- Unsuitable for small companies: With over 5,000 servers, it is expensive and complex for small businesses.

- Negative profit margin: EBITDA margin of 0.1% and ROE of -131.47%, making investment risky.

- Market volatility: As a penny stock, indicators like RSI 34 suggest an oversold condition, but the likelihood of a decline is high.

Future plans of Hyperscale Data Inc.

The company is focusing on AI and digital assets after 2025. Key plans:

- ACG Separation: In the first quarter of 2026, ACG’s sale will allow focus on pure data center operations.

- $125 million ATM program: This program, completed in November 2025, will strengthen the Bitcoin-based AI infrastructure.

- $100 million Bitcoin treasury: This strategy, launched in September 2025, will provide financial support to AI computing.

- Michigan Data Center Expansion: New centers with a capacity of 75 MW for AI, including water-efficient cooling systems. By 2030, the company aims to participate in $7 trillion global data center investment.

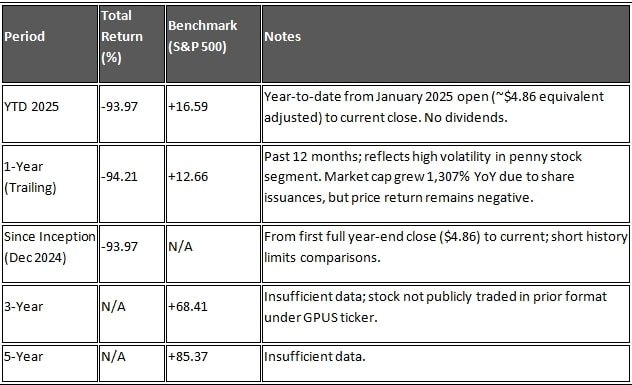

Total return given to investors

Hyperscale Data Inc. has currently delivered negative returns to investors. The trailing total returns (as of 4 December 2025) are negative, with ROA at -9.35% and ROIC at -15.43%. With a net margin of -38.8%, the company is still operating at a loss. However, in October 2025, the share increased by 18.72%, providing short-term positive signals. In the long term, returns could improve due to the Bitcoin strategy, but there is a risk of decline from the current price of $0.364 (as of 21 October 2025).

Impact of American government policy on Hyperscale Data Inc.

American government policies focus on energy, water, and environmental regulations for data centers, which directly affects GPUs.

- Increase in energy consumption: In 2024, data centers consumed 4% of electricity, which is expected to double by 2030 (up to 12%). This will increase regulation on GPUs at the Michigan center.

- Trump tariffs: Tariffs on servers and hardware will increase costs, which will affect the hyperscale market.

- Michigan local policies: $1 billion data center in Howell Township requires water-efficient systems, leading to increased environmental scrutiny.

- Positive side: States are encouraged by high-paying jobs and tax revenue, but states like Michigan need regulatory improvements. Overall, policies will limit company growth, but the AI boom increases the likelihood of receiving grants.

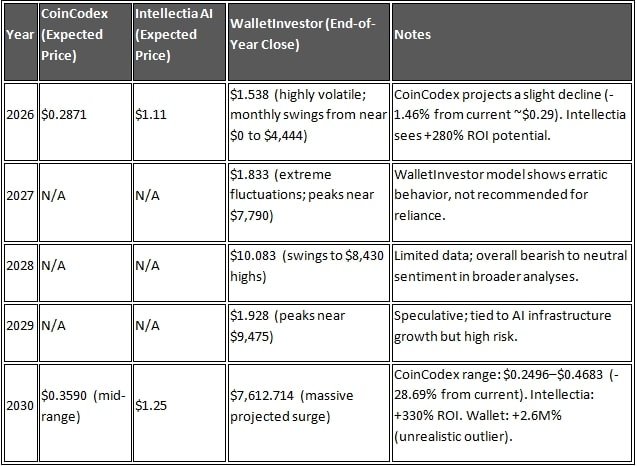

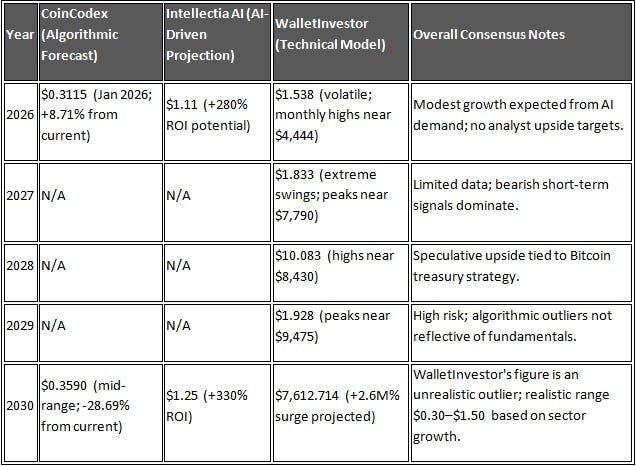

GPUS Stock Price Forecast 2026 to 2030

Since GPUS is a penny stock, there is significant uncertainty in its long-term forecasts. Due to the current market volatility (with the share price around $0.28 to $0.31 until December 2025), analysts’ predictions exhibit both positive and negative perspectives.

According to CoinCodex, GPUS stock are likely to increase by 8.71% to reach $0.3115 by the beginning of 2026 (January 2, 2026). However, according to StockInvest’s short-term trend, the stock price is expected to remain between $0.110 and $0.160 over the next three months with a decline of 38.66%, indicating weak performance with 90% confidence.

In the long-term perspective, platforms such as WalletInvestor have provided highly optimistic forecasts: by the end of 2030 (November 2030), the share price is likely to reach $7612.714, indicating a substantial return on a five-year investment. These predictions are based on the growing demand for AI data centers, which includes the company’s expansion of its Michigan data center. However, these forecasts are highly speculative and risky due to market volatility, such as the fluctuations in Bitcoin.

American Stock Market Analysts’ GPUS stock price forecast 2026 to 2030

American analysts provide very limited specific forecasts for GPUS, as it is a small company and receives less coverage compared to major market players such as Nvidia. According to AI-based analyst platforms like Danelfin, GPUS’s structural demand growth is positive due to AI/ML computing, which is expected to increase from 2026 to 2030 owing to the scale of the economy. However, discussions on Reddit and penny stock forums suggest that analysts view the company’s efforts to reduce debt ($30 million) and secure $24 million in cash positively, but express concern over short-term declines.

Overall, analysts are divided: The AI boom could lead to a 10-20% increase by 2026, but for the company to reach over $100 by 2030, ACG needs to stand out and the Bitcoin treasury strategy must succeed. According to market cap estimates of companies like Nvidia ($20 trillion, with GPU growth expected at 352%), smaller players like GPUS might benefit, but the competition is intense.

Conclusion

GPUS stock are opportunity-laden yet risk-filled from 2026-2030 due to AI growth. While analysts remain optimistic, the company needs to separate ACG and address environmental challenges. Investors should exercise caution. Hyperscale Data Inc.’s Bitcoin-AI integration could be a long-term strength, potentially yielding sustained returns.

Disclaimer | This is not financial advice. Stock prices are volatile, and the market is subject to risks. Seek the assistance of a professional advisor before investing.