Roblox Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 22 December 2025: Roblox Corporation (NYSE: RBLX) is a major online gaming and metaverse platform that allows users to create and play games. The company, which went public in 2021, has brought a big revolution in the gaming industry. In this article, we will take a detailed look at Roblox stock price forecasts from 2026 to 2030, predictions by American stock market analysts, the company’s pros and cons, its plans, the total returns provided to investors, and the impact of US government policies on the company’s products or services. This forecast is based on various analysts’ reports and considering market volatility, it is for informational purposes only.

Pros and cons of Roblox Corporation

The pros and cons of investing in Roblox are as follows:

Pros

- Large user base: Roblox has millions of users on its platform every day, which boosts revenue from ads and in-game purchases.

- Metaverse and diversification: The company is expanding into the Metaverse, opening up opportunities in areas like education, music and social media beyond gaming.

- Positive cash flow: Free cash flow is expected to be 621 to 636 million dollars in 2024, making the company financially strong.

- Growth potential: According to analysts, the stock could increase fivefold.

Cons

- Not profitable: The company is still not making a profit and it’s unlikely to do so anytime soon.

- High valuation: The stock’s P/S ratio is 14, which is expensive and perfect results are expected.

- Stock dilution and volatility: Shareholders have to face dilution and the stock is volatile since it is a growth stock.

- Concern about the business model: Some analysts say the business model isn’t very appealing, especially regarding graphics and content quality.

Plans of Roblox Corporation

Roblox is focusing on platform maturity and expansion in 2025-2026. Key plans:

- Increasing user age: The company is implementing an age estimation system for all users to provide content according to their age.

- Ads and revenue growth: Expecting to earn 10% of gaming content revenue and 9 billion dollars from ads by 2030

- Social media integration: Make it like social media with features like ‘Roblox Moments’.

- Developer support: Increase DevEx by 8.5% to give developers more money.

- Financial goal: $4.39 to $4.49 billion revenue and $1.2 billion FOCF in 2025, expecting $1.4 billion FOCF in 2026.

- Security improvements: More than 100 security initiatives, like Trusted Connections.

Total return given to investors by Roblox Corporation

Roblox went public on 10 March 2021, with the stock closing at 69.50 USD. By December 2025 (with the available price on 19 December being 81.94 USD), the price increased by 12.44 USD, giving a return of about 17.90%. The company doesn’t pay dividends, so the total return depends entirely on the price increase. This return is moderate due to market volatility, but with the company’s growth, improvements are expected in the future.

The US government’s policies affect Roblox Corporation’s products or services

The US government’s policies have a big impact on Roblox, especially on child safety and online privacy, since there are lots of kids on the platform.

- Child safety laws: Due to policies like the FTC and COPPA, Roblox has to protect kids’ privacy. Recently, the states of Kentucky and Louisiana have filed lawsuits against Roblox over sexual content and failure to protect children. South Carolina has also started an investigation.

- Online Safety Bill: Roblox supports federal laws like the “Take It Down Act,” which implement changes in the platform for user safety.

- Fraud protection: The Consumer Financial Protection Agency has proposed protection against Robux scams under the new definition of the Electronic Funds Transfer Act.

- Legal partnership: Roblox works with law enforcement agencies, but problems arise due to violations by vigilante groups.

- Financial impact: This policy increases the company’s security costs, but in the long run, it boosts trust and strengthens financial contributions (like the economic impact in the US).

Roblox Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

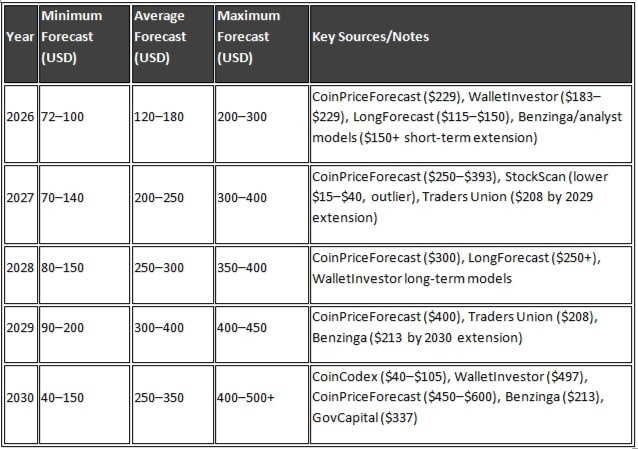

Opinions on Roblox stock’s future prices vary among different analysts, but most are positive about the company’s growth potential. The stock is expected to rise due to user growth, advertising and metaverse expansion. The table below shows key forecasts from 2026 to 2030:

American stock market analysts like Morgan Stanley, Wedbush and Sands Capital have recognized Roblox as the company with the highest growth potential in the gaming sector. They expect increases in user growth, advertising revenue and earnings of over 9 billion dollars. However, some analysts like CoinCodex do foresee a short-term dip. Overall, the stock rating is ‘buy’, with an average target price of 141.36 USD.

Overall, Roblox’s future growth looks promising, but keep in mind regulatory challenges and market volatility. Get professional advice before investing.