RR Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

New York, 10 December 2025: RichTech Robotics Inc. (NASDAQ: RR) is an American company that develops advanced robotic technology for labour-intensive tasks in the service sector. The company produces AI-based robots for hospitality, healthcare, and other sectors, such as ADAM (robot bartender and barista) and Scorpion robots. Listed on Nasdaq, the company (Penny Stocks to Buy Now) went public in 2023 and has experienced volatility in its stock price. As of December 2025, RR’s share price is around $4.30. Against the backdrop of growth in the robotics industry, this company appears as a significant opportunity to investors.

In this article, we will discuss the RR stock price prediction 2026 to 2030, by American analysts, the company’s strengths and weaknesses, future plans, returns provided to investors by Strive Inc., and the impact of American government policies.

Pros and cons of RicTech Robotics Inc.

Richtech Robotics is a startup that could revolutionize robotics, but it’s facing growth challenges.

Pros:

- High gross margin: 74.6% gross margin, which shows the efficiency of the product.

- Nvidia collaboration and deployment: Deployment of 300+ robots in hospitality and healthcare; Nvidia’s Jetson AI integration.

- Cutting-edge technology: Multipurpose robots like ADAM, used for bartending, barista tasks, and making bubble tea.

- Positive market signal: Buy signal based on short and long-term moving averages; AI score 7/10 (Buy).

Cons:

- No profit: Deep loss, negative EBIT and ROE; revenue dropped by 55%.

- Chaos in management: Technical features inefficiently distributed; no plan for product development.

- High valuation: 7.8 times book value, high price for low sales.

- Stock volatility: The stock behaves like a ‘nightmare’, nothing makes sense.

Future plans of RicTech Robotics Inc.

RichTech Robotics is focusing on future AI and robotics expansion. The main plan:

- Collaboration with Nvidia: teaming up for production-ready AI robotics that will revolutionize ADAM’s capabilities.

- Capital raising and expansion: raising funds through a mixed securities shelf; a $4 million deal in China for ADAM, Scorpion and Titan robots.

- RAAS model: Robot-on-a-service, where clients can rent robots.

- Fleet expansion: 2,000 robots by 2026; 400+ robots deployed so far.

- Master services agreement: a two-year deal with a global retailer, opportunities for future projects. The company plans to turn profitable by 2026 by expanding its robot fleet and entering the Asian market.

Impact of US government policy on RichTech Robotics’ products/services

American government policies are boosting the robotics industry, which will benefit RichTech. The Trump administration is planning executive actions to encourage robot production, including subsidies and supply chain stability. According to the ITIF report, Congress and the administration should take simple steps to boost robotics, like tax breaks and research grants.

This policy will benefit RichTech’s products like ADAM and Scorpion:

- Positive outcome: American robot production will increase, reducing import dependence and keeping prices stable. In December 2025, due to rumors’ about these policies, RR shares went up by 29.3%.

- Possible challenges: If regulations increase (like AI safety), development costs might go up. But overall, this policy will help the company’s hospitality robots tackle labor shortages.

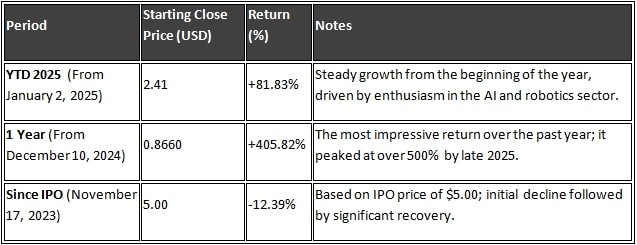

Total return given to investors by RichTech Robotics Inc.

RicheTech Robotics INC. (NASDAQ: RR) is an emerging company in the robotics field that went public through an IPO in November 2023. the company has provided investors with varying returns over different periods, mainly based on share price fluctuations (as the company has not paid any dividends yet). according to the latest information up to 10 December 2025, the ups and downs in the company’s stock prices have given investors high returns with high risks. the section below details the total returns over various periods.

Total returns over various periods

RicheTech Robotics shares have shown impressive growth over the past year, giving investors a nice return. However, the overall performance since the IPO has been mixed. The table below shows the returns for key periods (Source: Polygon Stock Data, latest closing price as of 9 December 2025: $4.34).

Note: These returns are based only on changes in share prices. They do not include dividends or other distributions, which are currently zero.

Analysis of returns

- Positive aspect: In 2025, RR shares gave returns of over 80%, which is way higher than the S&P 500 index’s average 20-25% returns. Last year’s 414% return was made possible by the company’s AI-based robots (like ADAM) expansion and partners like Nvidia. According to Zacks Research, by November 2025 there was a 447% increase, which is impressive compared to competitors like Smart Rent. These returns reflect the AI revolution in the robotics industry.

- Negative aspect: The IPO shows a -13% return over two years, meaning the initial share price dropped from $5 (common for new companies). According to Finbox, some reports showed a 144% return for one year, but new data shows 414%, indicating market volatility.

- Future expectations: According to analysts’ forecasts, revenue could reach 5 million dollars by 2026, which could boost returns. However, a lack of profit and high volatility increases risk.

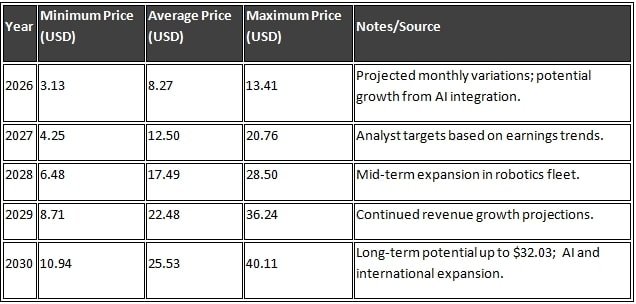

RR Stock Price Forecast 2026 to 2030: Penny Stocks to Buy

Due to the AI revolution in the robotics industry, there are positive forecasts for RichTech Robotics’ share prices, but there are also risks due to volatility and lack of profitability. According to various sources, the following estimates are:

RR Stock Price Forecast 2026

The average price is expected to be $8.2694, with a maximum of $13.41 and a minimum of $3.1325. According to Wall Street analysts, the average target price is $4.25, with a range of $2.50 to $6.00.

RR Stock Price Forecast 2027 to 2028

Moderate growth is expected, with revenue potentially reaching 28-31 million dollars due to the expansion of the robot fleet.

RR Stock Price Forecast 2029 to 2030

According to some estimates, the price will remain between $3.16 and $4.52, while others have forecasted up to $2.42. In the long term, there could be a 2450% increase by 2045, averaging $110.68.

These estimates depend on AI integration, robot sales, and market expansion. However, due to the current lack of profit (negative EBIT and ROE), the price may decline.

RR Stock Price prediction of American stock market analysts

American analysts maintain a mixed outlook on RR shares. Based on two analysts on Wall Street, there is a neutral consensus with a median target price of $4.25 (range of $2.50-6.00). According to Nasdaq, the average target is $3.83, which is 63% higher than the current price, indicating an overly optimistic market.

According to stock analysis, the 12-month target is $6.00, indicating a 37% increase from the current level. Simply Wall Street’s fair value is $3.94, which is 47% lower than the current price. The average estimate for 2026 is $8.27 and for 2030 is $3.13. Overall, analysts are optimistic about AI and robotics growth, but cautious due to the lack of profitability.

Conclusion

Richtech Robotics Inc. is an emerging force in the robotics revolution, with positive forecasts for its share prices between 2026-2030 (average $4-8). Although analysts’ predictions are optimistic, the lack of profits increases risk. Investors should be cautious, considering the company’s strengths (high margins, AI integration) and weaknesses (management chaos). Future plans (RAAS, international expansion) and government support will drive growth. Medium returns can be gained through funds like Strive Inc., but stocks like RR present high risk-high reward. Take professional advice before investing.