RVPH Stock Price Forecast 2026 to 2030: Best Penny Stocks to Buy

New York, 03 December 2025 │ Reviva Pharmaceuticals Holdings Inc. (NASDAQ: RVPH) is a clinical-stage pharmaceutical company developing novel drugs for central nervous system (CNS) disorders. The company’s lead drug candidate, ‘Brilaroxazine’ (RP5063), is being developed for severe mental disorders such as schizophrenia. The stock, traded on Nasdaq (Best Penny Stocks to Buy), currently trades at approximately $0.56, which is highly volatile and risky. By the end of 2025, although the company has shown progress in its clinical trials, long-term forecasts remain mixed. In this article, we will discuss projected share prices from 2026 to 2030, target prices from American stock market analysts, the company’s total debt, plans, relevant US government policies, and the company’s strengths and weaknesses. This information has been compiled from various financial sources and will serve as a guide for investors.

The company’s total debt

Reviva Pharmaceuticals Holdings Inc. has a stable financial position, particularly concerning debt. According to Yahoo Finance, the monthly resolution (MRQ) price up to September 2025 indicates that total debt is zero. According to SimplyWall.St, total shareholder equity is $4.5 million with total debt at $0.0, resulting in a debt-to-equity ratio of 0%. The company has $13.2 million in cash as of September 2025, slightly lower compared to October 2025. However, short-term debt of $224,300 was reported in the first quarter. Overall, the company is debt-free, which is positive for its growth, although operating expenses ($6.07 million in the second quarter) are increasing.

The company’s plans

Reviva’s plan is focused on brexaroxazine. The company completed the RECOVER-1 trial in 2025, and the 12-month open-label extension trial showed positive data on inflammatory impact and negative symptoms. According to RTT News, an NDA submission for schizophrenia is possible by 2026, with the RECOVER-2 phase 3 trial expected to start in mid-2025. In November 2025, a European patent was obtained, covering the use of brexaroxazine for pulmonary fibrosis. The company’s pipeline includes RP1208, a second drug for CNS, inflammatory, and cardiometabolic disorders. The plan is to meet with the FDA to determine the approval pathway, potentially enabling a commercial launch between 2026-2027.

Policies of the US government regarding the company’s production

The US government, particularly the Food and Drug Administration (FDA), is implementing new policies for schizophrenia treatments, which are beneficial for drugs with novel mechanisms of action, such as Reviva’s Brilaroxazine. In September 2024, the FDA approved Kobenfi (Xanomeline and Trospium Chloride) for schizophrenia, which uses a novel mechanism with fewer side effects compared to traditional antipsychotics. In February 2025, the Risk Evaluation and Mitigation Strategy (REMS) programme for clozapine was discontinued, removing mandatory blood tests and facilitating easier access to treatment. This policy is advantageous for patients with treatment-resistant schizophrenia and will pave the way for new drugs like Brilaroxazine.

The FDA is prepared to accept drug claims for negative symptoms (such as social withdrawal), which aligns with Reviva’s trial data. In November 2024, the FDA voted to reduce barriers for clozapine, which will encourage new therapies. Overall, these policies are positive for Reviva’s product, as the FDA is prioritizing drugs with new mechanisms.

Positive and negative aspects

Positive aspects:

- New pipeline: Strong clinical data and extended patents for Brilaroxazine (schizophrenia and pulmonary fibrosis), offering multi-project opportunities.

- Low debt: zero debt and 13 million dollars in cash, which is sufficient for trials.

- Analyst support: ‘Strong Buy’ rating and high target prices, which depend on successful approval.

- Government support: New FDA policies will increase access to treatments.

Negative aspects:

- No revenue: the company is not yet commercial, and operating losses ($6 million quarterly) are increasing.

- Liquidity Issue: Current ratio is 0.9, indicating that short-term liabilities exceed cash.’

- Volatility: Some forecasts indicate that shares could reach zero by 2030 due to trial failures.

- Initial stage: As it has not generated income, the investment is risky.

According to Trendline, the company has 4 strong points (new drugs) and 10 weak points (financial losses).

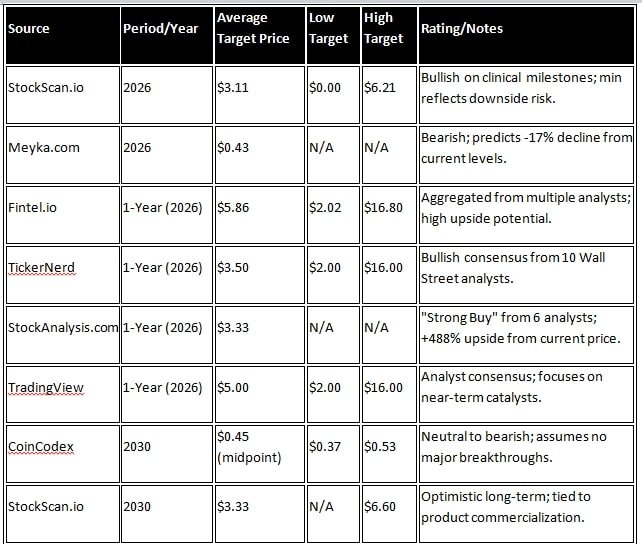

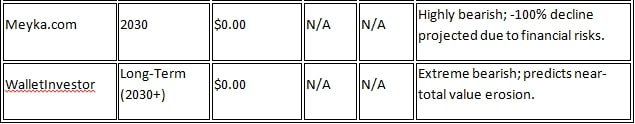

RVPH Stock Price Forecast 2026 to 2030 and US market analysts’ predictions

Long-term projections for RVPH shares vary among different analysts. Most forecasts depend on the success of the company’s Brilaroxazine drug, which is expected to have its NDA (New Drug Application) submission by 2026. According to Stockscan.io, the average share price in 2026 will be $3.1094, with a maximum estimate of $6.2093 and a minimum of $0. However, sources such as Meiyka.com have painted a negative picture, with a projected price of $0.43 (-17.42% change) in 2026 and $0.00 (-100% change) by 2030, due to the company’s financial instability.

Wall Street analysts’ forecasts are more optimistic. According to Fintel.io, the one-year average target price is $5.86, with a range of $2.02 to $16.80. On SecuritiesAnalysis.com, six analysts have given a ‘strong buy’ rating, with an average target price of $3.33, indicating a 487.72% increase over the current price. According to MarketBeat.com, nine analysts have an average target of $3.86, with a maximum of $7. For projections up to 2030, StockScan.io cites an average of $3.3289 and a maximum of $6.5959. However, platforms such as CoinCodex have a negative forecast of $0.37 to $0.5277 for 2030.

Overall, analysts are giving a ‘Strong Buy’ rating, as the company’s clinical success is likely to drive an increase in its shares. However, considering the risks in the biological pharma sector, a range of $2-6 in 2026 and $0-7 in 2030 is expected. Investors should keep an eye on the company’s trial results.

Conclusion

RVPX stock may range from $0 to $7 between 2026 and 2030, depending on analysts’ optimistic forecasts based on the success of brilaroxazine. A debt-free position and FDA policies are positive, but the lack of revenue and trial risks are negative. Investors should monitor the company’s FDA meetings and trial updates. This information is general; seek professional advice.

Disclaimer | This is not financial advice. Share prices are volatile and the market is subject to risks. Seek the assistance of a professional advisor before investing.