SGMO Stock Price Forecast 2026 To 2030: Penny Stocks Under $1

New York, 02 December 2025 │ Sangamo Therapeutics Inc. (NASDAQ: SGMO) is a clinical-stage biotechnology company focused on gene editing and genomic medicine. The company’s products include gene therapy treatments for Fabry disease, Hemophilia A, and other rare genetic disorders. The current price of SGMO stock is approximately $0.46, which has declined due to the company’s financial and regulatory challenges. However, progress in the company’s pipeline and favorable FDA policies indicate potential growth in the future. In this article, we will discuss in detail the price forecasts of SGMO Stock Price Forecast from 2026 to 2030, analysts’ target prices in the US stock market, the company’s positive and negative aspects, debt status and plans, as well as US government policies.

The positives and negatives of Sangamo Therapeutics Inc.

Positive points (strength)

- Promising pipeline: Good clinical data have been obtained for gene therapy (ST-920) for Fabry disease, which could be revolutionary for rare disorders. The company’s ZFP gene editing technology is a strong asset.

- Diversity: Various programmes for pain, prion disease and neurological disorders, including a partnership with Astellas (2024).

- Fund capacity: A debt-free position and focus on R&D gives the company flexibility.

Negative points (weakness)

- Financial shortfall: Continuous losses leading to cash shortage; revenue fell from 49.4 million dollars to 0.6 million dollars in the third quarter of 2025.

- Loss of partnership: Pfizer was hit when it shut down the haemophilia A programme (giroctocogene fitelparvovec) in December 2024.

- IP and regulatory risk: intellectual property risk and the likelihood of clinical trial failure.

The company’s debt situation and plan

Sangamo Therapeutics Inc. is debt-free, which is a great strength. By June 2025, the company has $38 million in cash and a debt-to-equity ratio of 0%. However, in the third quarter of 2025, the total operating expenses were $36.134 million, leading to an increase in losses.

The company has extended the cash runway until late Q3 2025 and has plans to raise additional capital, including new partnerships and fundraising. The strategy is to maintain lean operations by focusing on the Fabri programme. There is a possibility of receiving new funding after the BLA submission by the end of 2025.

Policies of the US government on Sangamo Therapeutics Inc. products

The US government, particularly the FDA, implements favorable policies for gene therapy products. Sangamo’s products have received several special designations:

- Fabry gene therapy: In November 2025, the FDA accepted the BLA rolling submission, which is based on the accelerated approval pathway. The submission will begin in Q4 2025.

- Fast track and rare pediatric diseases: SB-525 (Hemophilia) and SB-913 received fast track (2017) and rare pediatric disease designation.

- Regulation: The FDA regulates gene therapy as a biological product, focusing on safety and efficacy.

These policies make it easier for the company to get quick approvals and market access, which is positive for share growth.

SGMO Stock Price Forecast of analysts in the US stock market

Leading analysts in the US stock market are showing a positive outlook for SGMO shares, despite short-term challenges. Currently, according to 7 to 10 analysts, the overall rating for the company is “Buy”. The average target price is $4.71 to $4.85, indicating a potential increase of up to 985% from the current price. The highest estimate is $10.00 (HC Wainwright & Co.) and the lowest is $1.00 (Barclays).

After weak economic results in the third quarter of 2025, some analysts have lowered target prices. For example, Barclays cut its target from $5 to $1 in May 2025, based on the company’s cash shortfall. Nevertheless, according to TipRanks, the average target is $4.33, indicating an increase of 841%. According to Wall Street Zen estimates, earnings for 2025 will be -$99.94 million, due to the company’s research expenses.

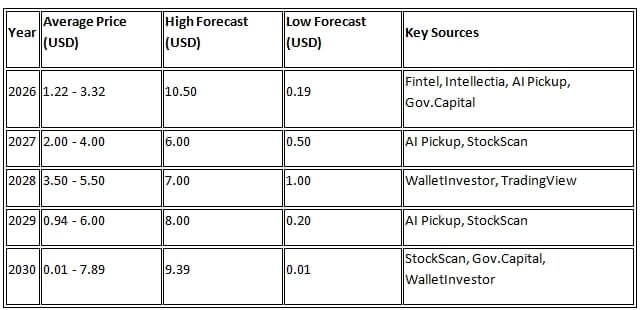

SGMO Stock Price Forecast 2026 to 2030

There is significant variation in the long-term forecasts for SGMO shares, which depends on the success of the company’s gene therapy pipeline. According to various AI-based and analytical models, the forecasts are as follows:

Some models (such as WalletInvestor) are extremely pessimistic and predict the price could fall to $0.000001 by 2030 due to the company’s financial instability. On the other hand, sources like StockScan indicate an average increase to $7.89 by 2030, depending on FDA approval and partnerships. Overall, there is a potential for 100% to 600% growth by 2026, but the company will need new capital to achieve stability by 2030.

Conclusion

SGMO shares could rise to the range of 1 to 10 dollars between 2026 and 2030, but this requires FDA approval and capital. The company’s strong technology and regulatory support are positive, however financial instability is a major challenge. Investors should take a long-term view considering the risks. For more information, refer to the company’s official website.

Disclaimer | This is not financial advice. Share prices are volatile and the market is subject to risks. Seek the assistance of a professional advisor before investing.