SpaceX IPO in 2026? How much return expected in SpaceX Stock?

New York, 22 December 2025: SpaceX, the revolutionary space company led by Elon Musk, is preparing to go public through an IPO (Initial Public Offering) in 2026. This IPO could be the largest in American history, potentially valued at up to 1.5 trillion dollars and expected to raise more than 30 billion dollars. The company is ushering in a new era in space, aiming to connect the world through projects like Starlink, Starship, and space-based AI data centers.

In this article, we will take an in-depth look at what American stock market analysts think about SpaceX’s IPO, the pros and cons, the company’s plans, the overall returns given to investors, the impact of US government policies, and advice from American experts for investors.

American stock market analysts’ opinions on the SpaceX IPO 2026

Analysts in the American stock market are really excited about SpaceX’s IPO. According to Andrew Roco, Stock Strategist at Jacks Investment, “SpaceX’s IPO will be the most anticipated and successful IPO in history.” According to Payload Space analysts, the company’s revenue is growing at 50% or more, reaching 22 to 24 billion dollars by 2026. According to Fortune, this IPO will value SpaceX at 1.5 trillion dollars, which is 60 times its current annual sales.

Some analysts believe this IPO will be a catalyst for companies like Alphabet (Google), as Google’s investment in SpaceX could return 125 times. However, some have warned about the risks of high valuation, such as market conditions and dependence on Elon Musk. Overall, this IPO could be the biggest event in 2026, benefiting other space sector companies like Rocket Lab and AST SpaceMobile.

Pros and cons of SpaceX IPO 2026

Pros

- Fundraising and expansion: Raising over $30 billion through an IPO will boost projects like SpaceX Starship, Starlink and space-based AI data centers. This will help the company build human settlements on Mars and space-based computing centers.

- Opportunity for investors: Employees and existing investors will get liquidity, and even investors themselves will have a chance to invest directly in SpaceX.

- Market impact: This IPO will bring the space economy into the mainstream, encouraging other private companies.

- Democratization: Tesla shareholders might get priority in the SpaceX IPO, as mentioned in Bill Ackman’s proposal.

Cons

- High valuation risk: The 1.5 trillion dollar valuation is 60 times the current revenue, which could be risky due to market volatility.

- Elon Musk dependency: The company’s success depends on Musk, which could be affected by political and personal issues.

- Regulatory hurdles: Getting approval from the FAA and other regulatory bodies can be tough.

- Market situation: The IPO could be affected by the 2026 economic slowdown or interest rate hike.

Highlight of SpaceX company’s plans

SpaceX’s main plan is to make space travel cheap and accessible. The company is developing the Starship rocket with the goal of setting up a human settlement on Mars. Through the Starlink project, it aims to increase internet connectivity worldwide, generating a revenue of 5.8 billion dollars in 2024. In the future, it plans to set up space-based AI data centres, which will be based on Starlink technology. By 2026, the company expects a revenue of 15 billion dollars and growth up to 22-24 billion dollars.

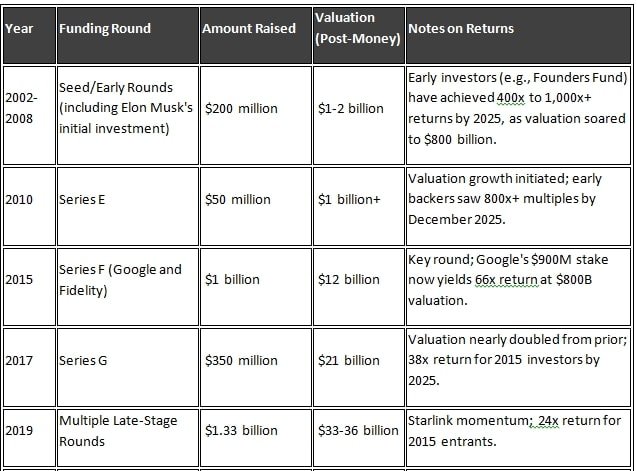

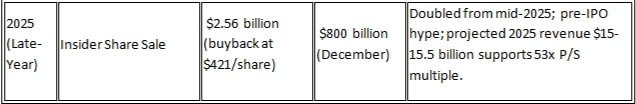

The total return SpaceX gave to investors

SpaceX has given investors huge returns. Since 2002, it has raised 11.9 billion dollars in 30 funding rounds. According to ARK Invest’s estimate, the company’s value will reach 2.5 trillion dollars by 2030, giving a 38% annual compound return. Google’s 900 million dollar investment has now increased 125 times. In 2024, revenue is 14.2 billion dollars, a 63% growth. Investors like Mirae Asset Group have made huge gains.

Impact of American government policies on SpaceX’s production or service

The US government relies on SpaceX, which has secured 21 billion dollars in government contracts. NASA and DOD contracts help the company with launches and satellite services. However, conflicts with the Trump administration put 22 billion dollars worth of contracts at risk. The FAA has fined 633,009 dollars, showing regulatory hurdles. Overall, government policies support SpaceX, but dependency increases risk.

SpaceX company’s future plans

SpaceX’s future plans include building a city on Mars with Starship, generating 5.8 billion dollars in revenue through Starlink, and developing space-based AI centers. The company aims for a 1 trillion dollar valuation and AI integration by 2026. The long-term goal: making humans a multi-planetary species.

American market experts advise US investors

American experts also advise retail investors to be cautious. According to Forge Global, retail investors cannot buy pre-IPO shares themselves, but it is possible through accredited platforms. According to Reuters investors, this will be the “craziest IPO,” leading to huge demand. According to TradingKey, retail investors can invest in SpaceX shareholders’ ETFs or supply chain companies. Forbes says SpaceX shares are not available on US exchanges, but consider the high risk post-IPO. Overall, do your own research (DYOR) and check your risk tolerance.